Who's really the boogeyman? The Greater Seattle Housing Market Update, July 2025

Welcome to the latest and greatest Greater Seattle Housing Market Update. I hope your summer is going well and you're getting plenty of vitamin D. As always, to jump right into the stats you can do so by clicking here. For more/better information (and hopefully some entertainment), keep reading below!

Given the subject of this article, I understand this would have been more appropriate to post in October, but I want to talk about something that's been grinding my gears for years. Or maybe I'm just experiencing writer's block? Either way, over the years I've consistently heard a lot of misinformation when it comes to our local housing market, but probably the most misunderstood belief I see, hear, and read all over the place is that investors are to blame for inflationary costs of real estate.

"If it weren't for investors gobbling up houses, first time home buyers would be able to buy." Or "we need to tax all the homes just sitting vacant or not allow homes to be used for investments". Or "investors are pricing out first time homebuyers." And dozens of different versions of these arguments.

I'll preface my response that, like everything, the validity of this belief/argument depends on one's location. I 100% believe that in some areas of the country this problem can be very real. However, as the data will show, there isn't any merit for this argument in the Greater Seattle area, let alone in Washington State.

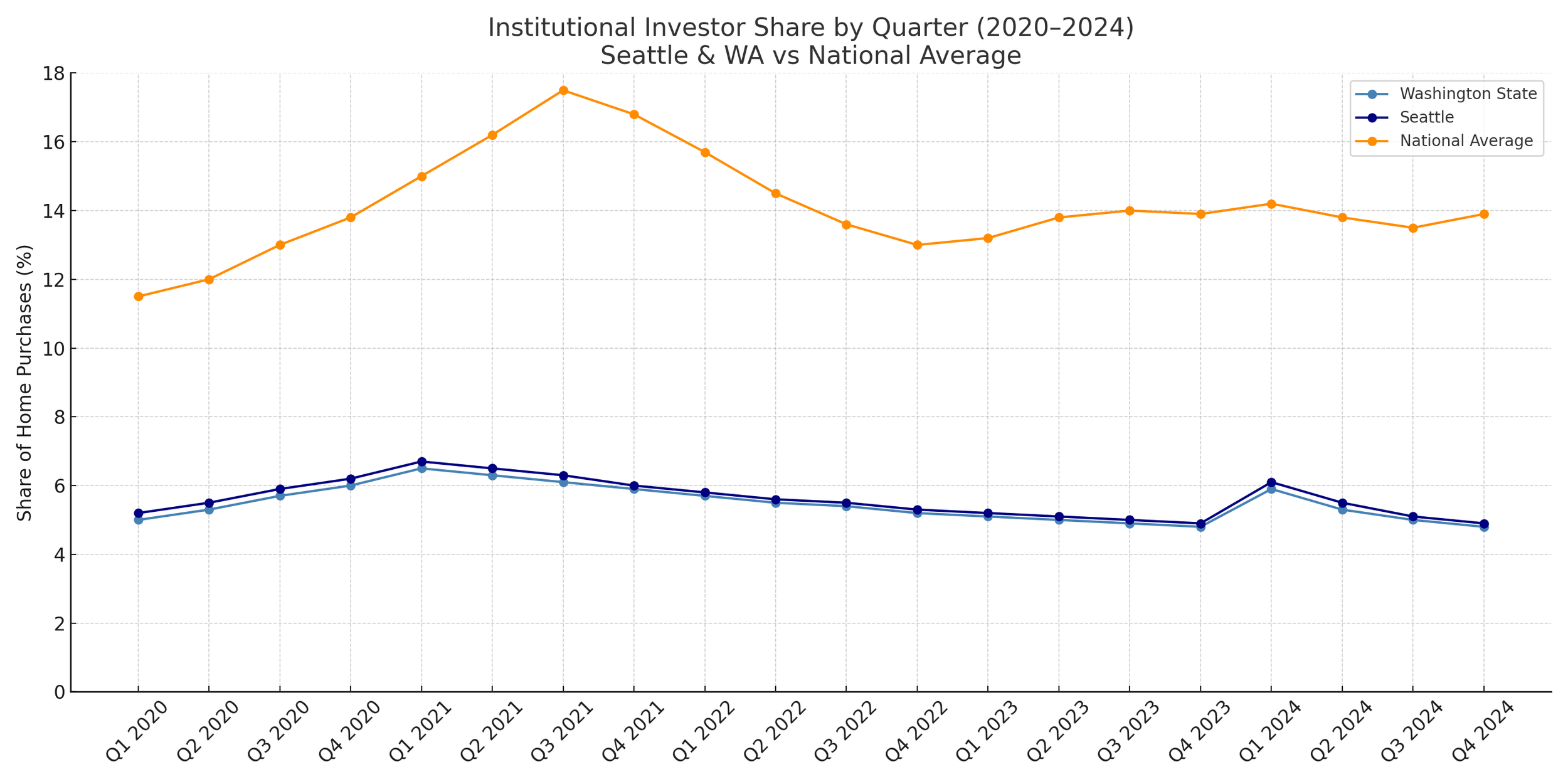

Institutional investors are defined as investors who purchase 10+ homes within a calendar year. This includes companies like Black Rock, probably the most infamous real estate investment brand when it comes to purchasing rental properties, and could also include very active flipping companies that operate within their own backyard. The graph above charts the purchase activity of institutional investors through the first quarter of 2025.

Above is for all of 2024.

And the above shows the comparison going back to 2020.

What is glaringly obvious is that institutional investors in the Greater Seattle area and Washington state are buying real estate at a fraction of the level compared to the national average. In fact, the median percentage of homes bought by institutional investors at this time was only 5.35% and 5.5% in Washington State and Seattle, respectively. Nationally, that median figure was 13.85%.

According to this article from the University of Washington, they estimate ~78,000 homes sold across Washington state in 2024. If we take the average rate of consumption by institutional investors for 2024 (5.4%), that's 4,200+ homes sold, which isn't totally insignificant, but it's hardly enough to single handedly point the blame at one demographic of the home buying population.

You want the dirty truth? Can you handle it?

The reality is that, if you're looking for a demographic of who to blame for rising housing prices...look in the mirror.

The truth can hurt, but it can also be revelatory. The buyer's in the Greater Seattle area you're competing against are likely to be very similar to you. They're not faceless investors competing to buy your home to simply add to their massive rental portfolio. Especially with the increase of mortgage rates over the past 3 years, it's even less likely they're investors at all whether that be institutional or mom and pop investors. Instead, they're just like you. A FTHB looking to get their foot into the door of homeownership. They're move-up buyers looking to expand their housing footprint to satisfy their expanding lifestyle. They're relocating into the city to be closer to work, they're moving to the suburbs for more space, they're relocating to another state to be closer to family, etc. You are the competition!

The data shows us that, rather than a single boogeyman existing, the market is made up of tens of thousands of different boogeymen and women, in more or less the same mold of each other. Don't get me wrong, investors contribute to inflated home prices, but not by any significant margin. It's our peers who are driving up the cost of homes, which of course has been exacerbated by the shortage of homes over the past 10+ years.

On that note...did you know that last month recorded the highest level of inventory in King and Snohomish counties (combined) since June 2019? And the months of inventory was the highest since January of 2019.

Yet, despite that, we set all time records for the median sale price in Seattle and King County.

I know. It defies intuition. See the stats below:

Seattle: June 2025 median sale price of $1,079,950. That is up 12.9% YoY and up MoM from $1,010,650. Inventory is up 35% YoY and the months of inventory dropped to 2.2 months from 2.5 months in May.

Eastside: June 2025 median sale price of $1,610,000. That is down 1.5% YoY and down from $1,633,500 MoM. Inventory is up 91.7% YoY and the months of inventory dropped slightly to 2.6 months from 2.7 months in May.

King County: June 2025 median sale price of $1,033,950. That is up 7.2% YoY and up MoM from $989,000. Inventory is up 49.7% YoY and the months of inventory dropped to 2.37 months from 2.45 months in May.

Have an amazing July! Onward!