The Calm Before the Storm; The Greater Seattle Housing Market Review for November 2025

We've almost made it past 2025!

Welcome to the latest edition of the Greater Seattle Housing Market Review. You might have noticed I'm slightly changing the wording of the title to reflect the previous month, since that's the data I'm referencing, as opposed to the month in which I create the report. This is also designed to provide more consistency to the blog feature on my website (recently revamped, check it out). As always, to skip the good stuff and go right to the stats, click here.

I create this writeup every year at this time, probably even plagiarizing the title year after year. At this moment, the market is dormant. New listings have been virtually non-existent since the beginning of November, leaving the few buyers out there with not much to look at or choose from. The result is that the market limps to the finish line at the end of the year like a wounded runner crossing the finish line at the conclusion of a grueling marathon. However, thanks to historical trends we can set our watch to, we know we're currently experiencing the calm before the Q1 storm. And when that storm hits, watch out.

There are a number of factors that can potentially contribute to a more robust housing market in early 2026. Many of which I've discussed in the past (and will do so again), starting with one that I don't think gets much attention; increasing conforming loan limits.

Increasing Conforming Loan Limits: Every year, Fannie Mae and Freddie Mac adjust their conventional loan limits based on changes in local housing markets (these increase every year). They recently announced that in our area (King, Snohomish, and Pierce counties) the maximum 2026 conventional loan limit will be $1,063,750. That's the loan amount, not the price. Given that buyers can purchase a home utilizing conventional financing with as little as a 5% down payment, that means a buyer could purchase a home priced at $1,119,000, put 5% down, and qualify for conventional financing. Of course, they'd still have to financially qualify for this monthly housing payment, which wouldn't be cheap, but it's all possible. As conventional loan limits increase, that means buyers can qualify for conventional financing at higher purchase prices, which could push prices higher.

Steady, if not lower, mortgage rates:

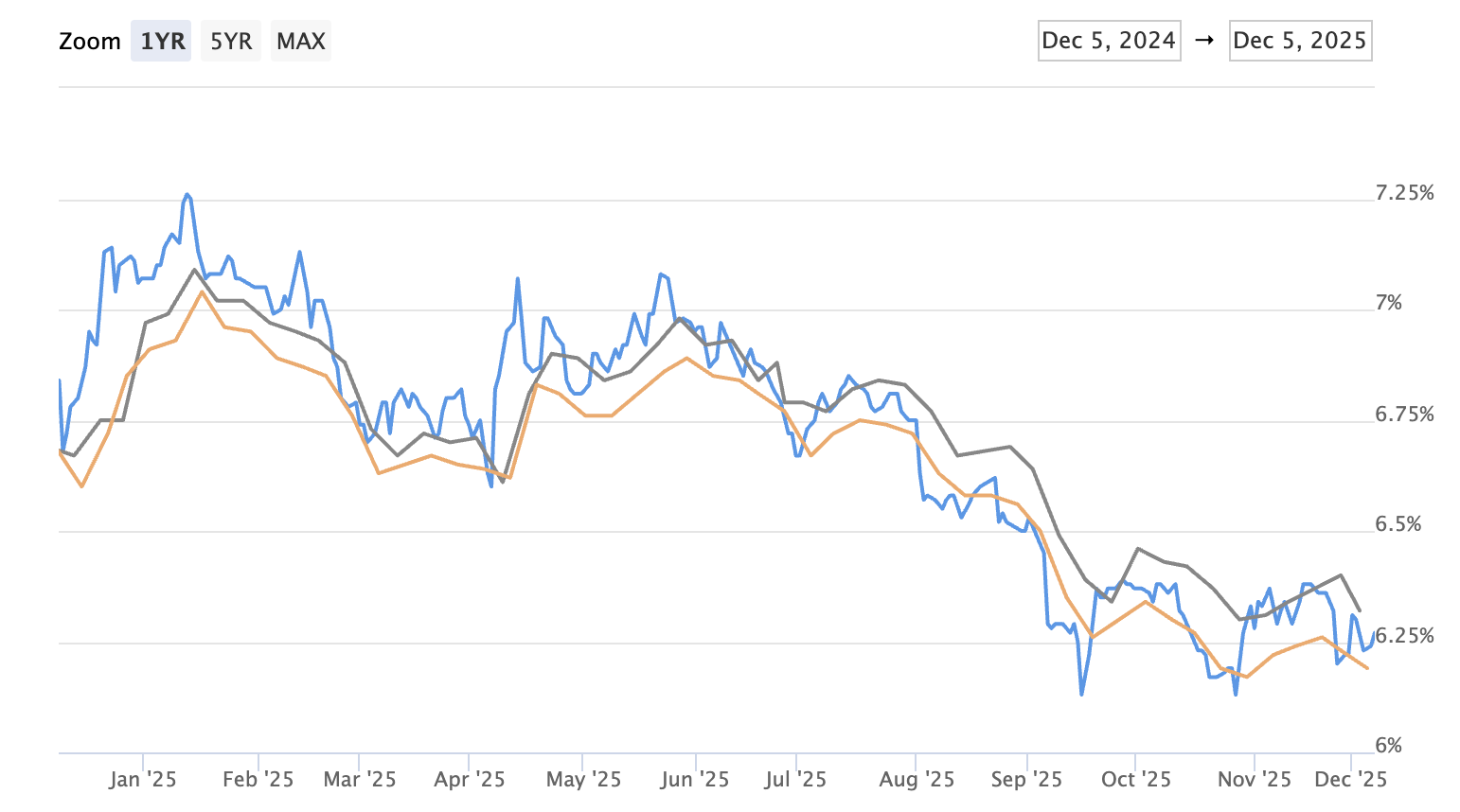

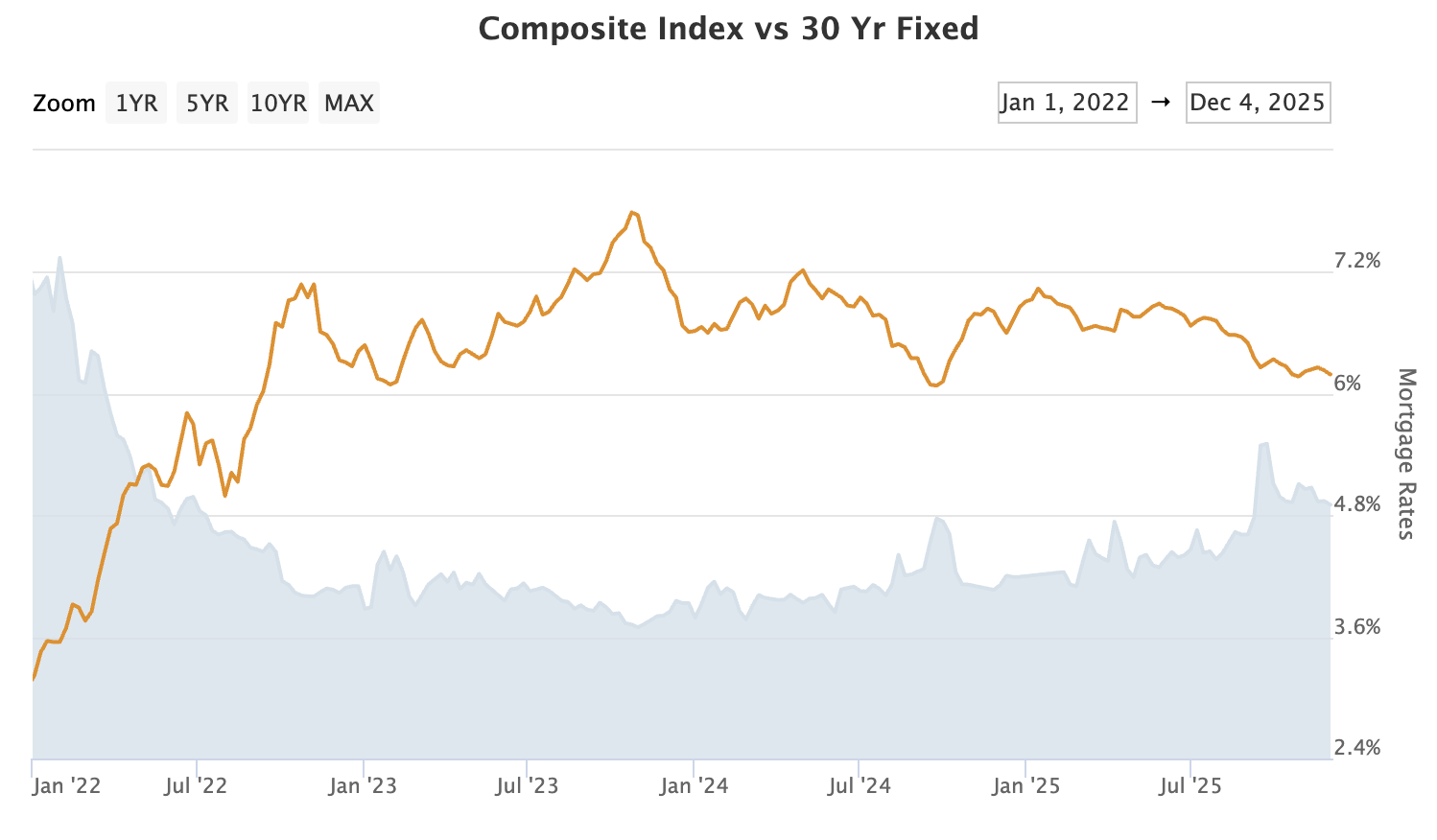

Look at how the 30 year mortgage interest rate has tread lower over the last year. It's not anything worth throwing a parade over, but they've come down .5-.75% during this time, which certainly helps from an affordability standpoint. Redfin recently published their 2026 housing outlook and they project interest rates to remain in the range in which we're currently sitting (low 6's). Personally, I feel that as long as mortgage rates are stable and not volatile where there are wild swings up or down, that stability creates consumer confidence, which brings more buyers into the market.

If rates not only stay where they're at, but actually trend lower, that could bring even more buyers into the market. A number to watch on this will be the unemployment rate. At the time I'm creating this report, the unemployment rate is 4.4%. The Federal Reserve has clearly shown their preference for labor data or inflation data in justifying interest rate cuts, but if the cracks within the labor market widen and turn into bigger issues, the Fed will feel increasing pressure to reduce their rate, which will send the 10 year treasury note below the current technical levels keeping mortgage rates in the low 6's. If this happens we could see rates in the high 5%'s (remember, the 10 year T-bill is what sets the 30 year mortgage, not the Fed funds rate). Of course, as discussed in previous reports, adjustable rate mortgages are already sub 6% so taking out an adjustable mortgage that's fixed for 7 or 10 years is more attractive than it's been in over a decade given the spread relative to the 30 year fixed. Lower rates could bring more buyers into the market, which can push prices higher.

Seasonality:

You're probably all tired of hearing me say this over and over again, but we have a very predictable housing market when it comes to seasonality. Thanks to decades worth of data, we know the first 4-5 months of every year are the most seller friendly. That is because of two things; low inventory and strong buyer demand.

(King and Snohomish County active inventory chars above, respectively)

Inventory is always at the lowest point for the year every January. From there it builds throughout the year, peaking anywhere between July and October, depending on the year.

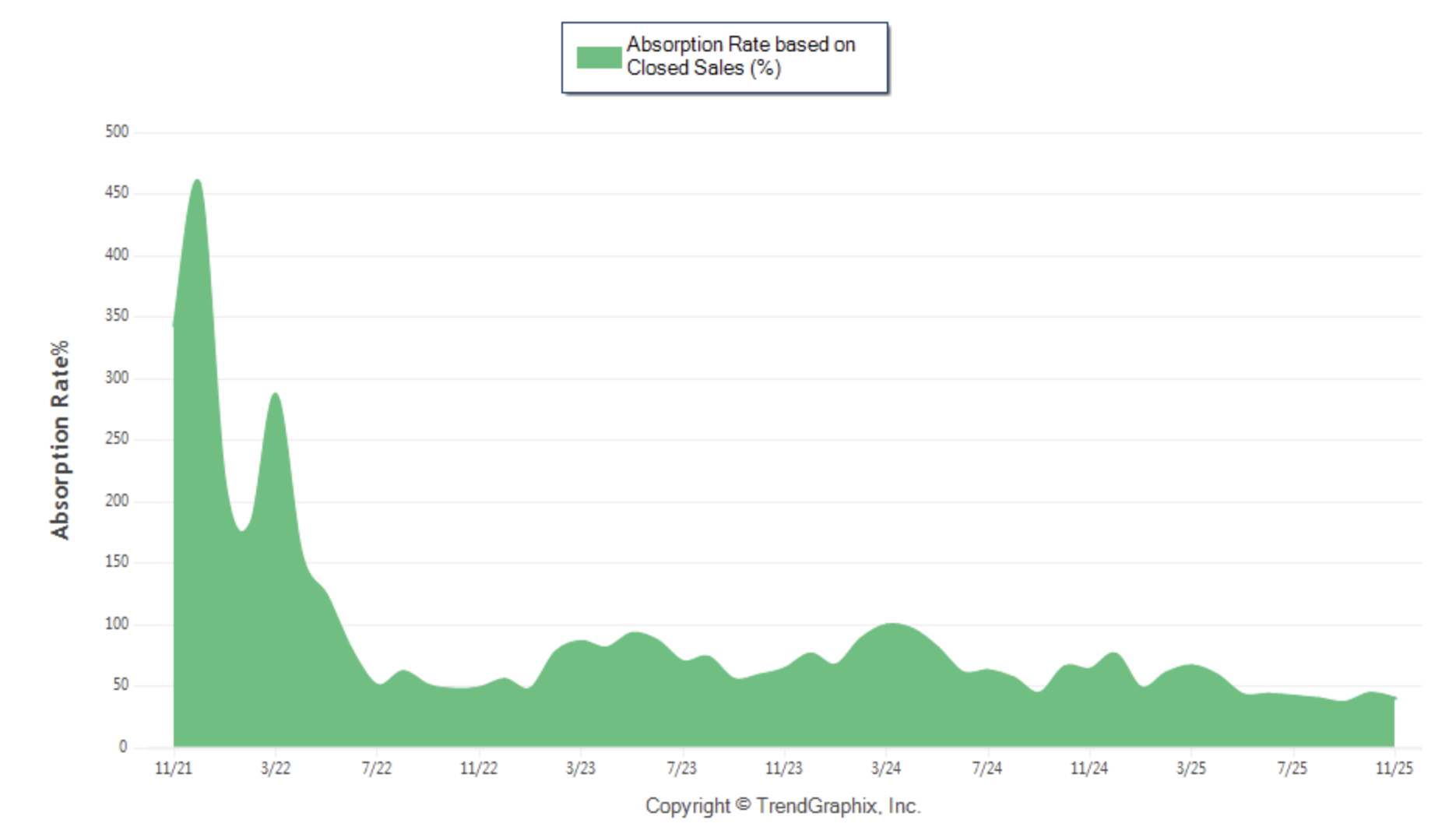

(Above) It's not the most obvious visual, but absorption is at its peak in the March-May timeframe of the year. Just look how insane the absorption was prior to the rapid interest rate increase during the summer of 2022.

Many of you are probably rolling your eyes because you've read or heard me preaching about this for years, maybe even experiencing it yourselves, but I'll throw one final curveball not yet discussed: new purchase mortgage application data.

Mortgage purchase applications are at their highest level since April of 2022.

While every Q1 and early Q2 are defined by low inventory, strong buyer activity, and sometimes fiercely competitive multiple offer situations, it's not crazy to suggest we might be in for a more intense, more seller friendly housing market than what we've seen in recent years. Buckle up!

Onto the stats:

Seattle: The November 2025 median sale price was $973,500. That is essentially flat YoY (up .57%) and down MoM from $1,050,000. Inventory was up 32.4% YoY and the months of inventory statistic actually increased MoM to 2.65 from 2.30. Seattle also set a new low (previous low was October 2025) for the lowest absorption rate since I've been tracking (2019).

Eastside: The median sale price was $1,430,000. That is down 7% YoY and down MoM from $1,550,000. In fact, November's reading was the lowest median sale price on the eastside since November 2023. Inventory is up 72.6% YoY and the months of inventory stat was flat at 2.41 months.

King County: The median sale price was $915,000, down 1.1% YoY, and down MoM from $997,000. Inventory is up 35% YoY and the months of inventory remained flat at 2.31 months.

Have a wonderful holiday season and enjoy time with your friends and family. We'll reconnect in 2026!