Fun With Demographics; The Greater Seattle Housing Market Review for 12/2025

Happy New Year!

And just like that, we are now 25% through the 21st century. Holy cow.

Welcome to the latest edition of the Greater Seattle Housing Market Review. As always, to skip the reading and jump right into the stats, you can do so by clicking here. For the rest of you, continue below!

As a Seattle Times subscriber, I've found the FYI Guy (Gene Balk) to consistently have some interesting articles. He's not the real estate beat writer for The Times, in fact his articles aren't ever about real estate, but it's not a stretch to find parallels between a few recent articles and the current, and future, outlook for our local housing market.

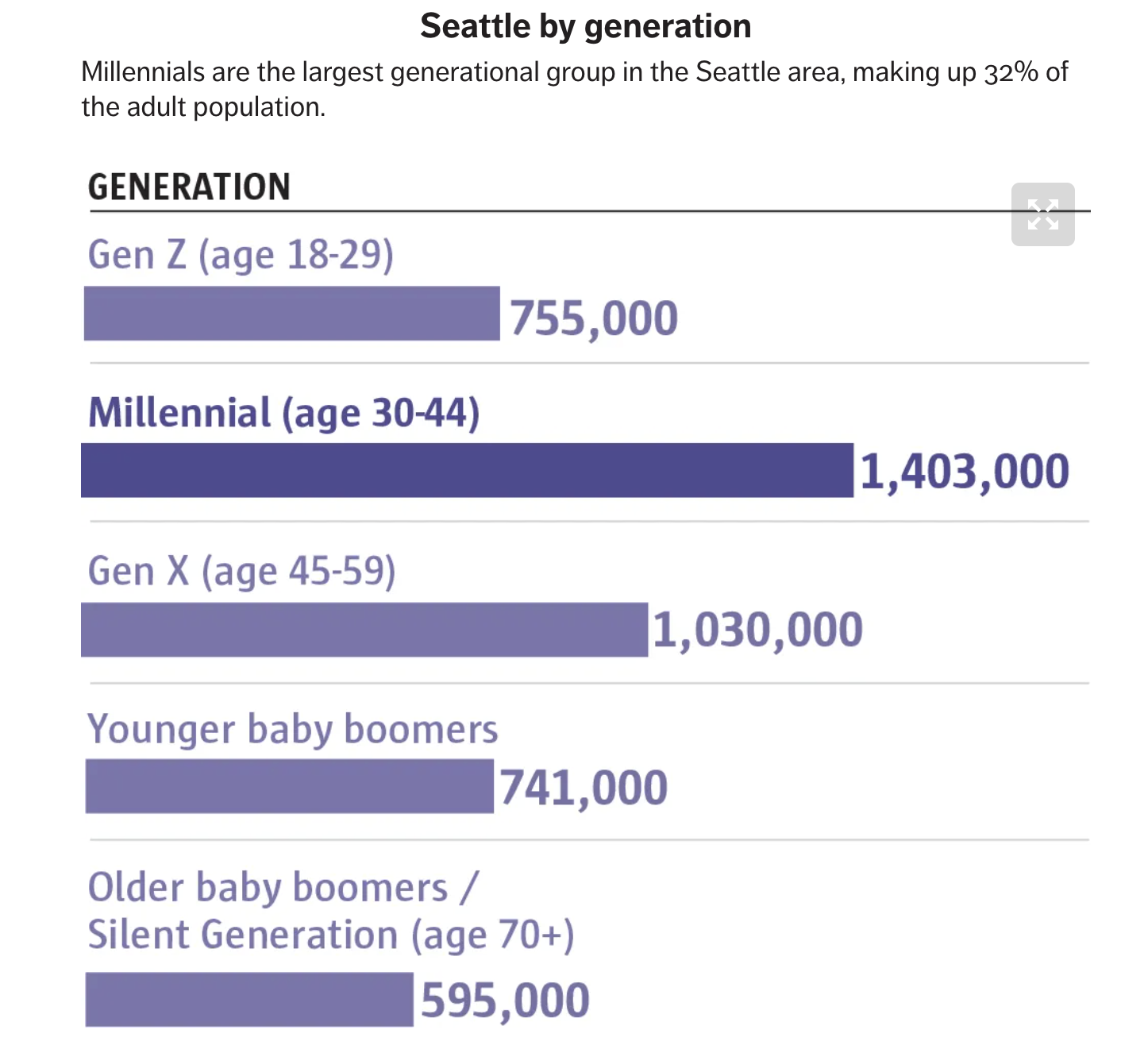

For starters, this story, published in mid December, identifies millennials as being the most populous generation in the Seattle metro area, accounting for over 1.4 million residents. This is largely due to the increase in millennials moving to Seattle during the 2010's while the local tech industry was on a hiring craze.

But what do we also know about millennials? We know that the median age of a first time home buyer has been increasing over the last number of years, finishing 2025 at 40 years old. There are many articles on this, but I'll link the article from NAR here.

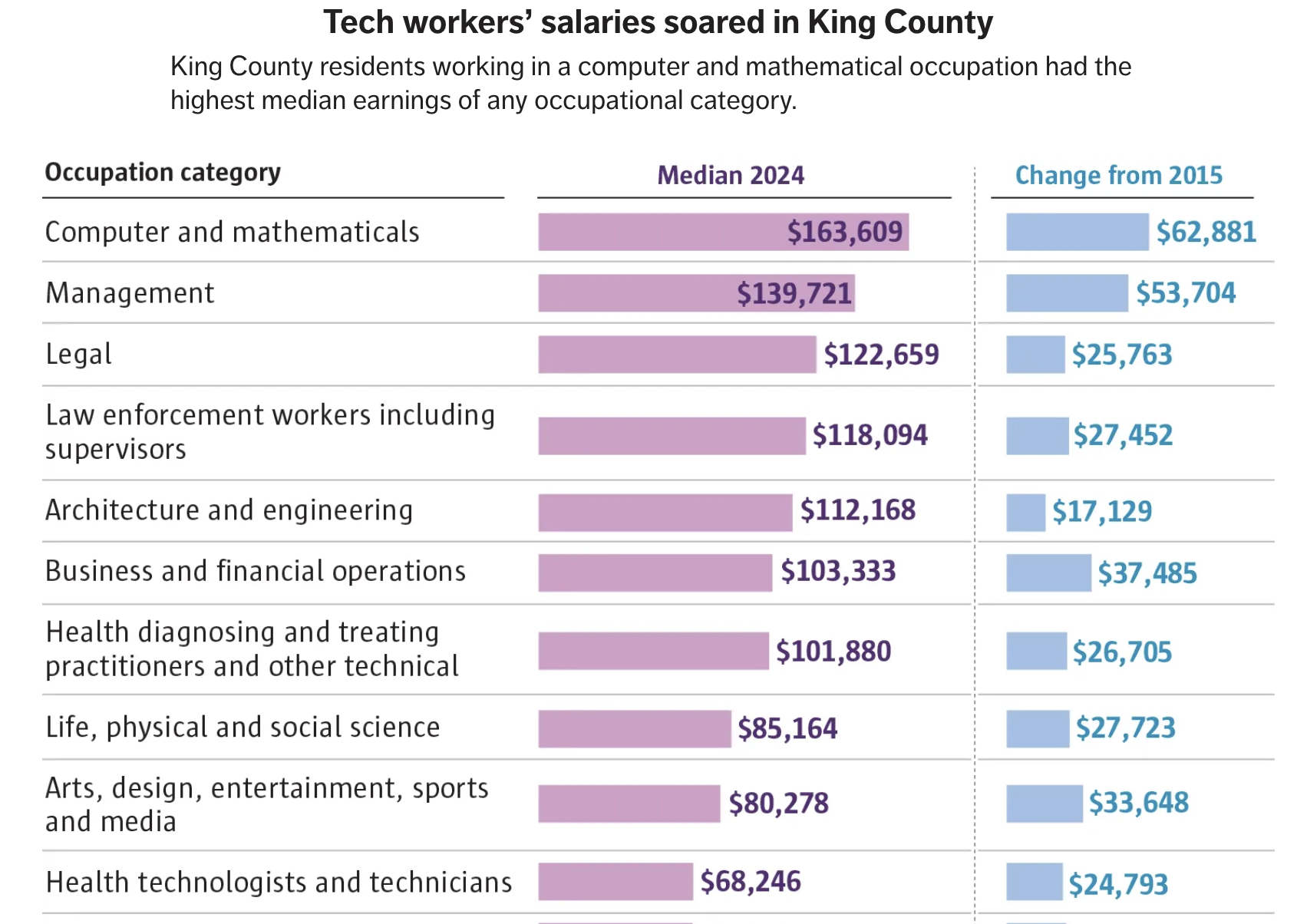

Circling back to tech, on December 9th the FYI Guy published this article, documenting the soaring pay within the tech industry over the past decade. See below the chart showing the gain in median incomes within different industries from 2015-2025.

Quick note; I'm always excited when they source data based around the median rather than the average since, especially with tech salaries, using the average could really swing the data dramatically. As a data nerd, I really like that and wanted to give a tip of the cap.

Another big take away I had in this article was the increasing pay gap within the tech industry. It's no secret just how male dominated the tech industry has, and continues to be, but it was surprising to see the gap between men and women actually increase from 2015-24. From the article, "in 2015 women in tech made 87.9% of what men earned. In 2024, that figure fell to 78.7%".

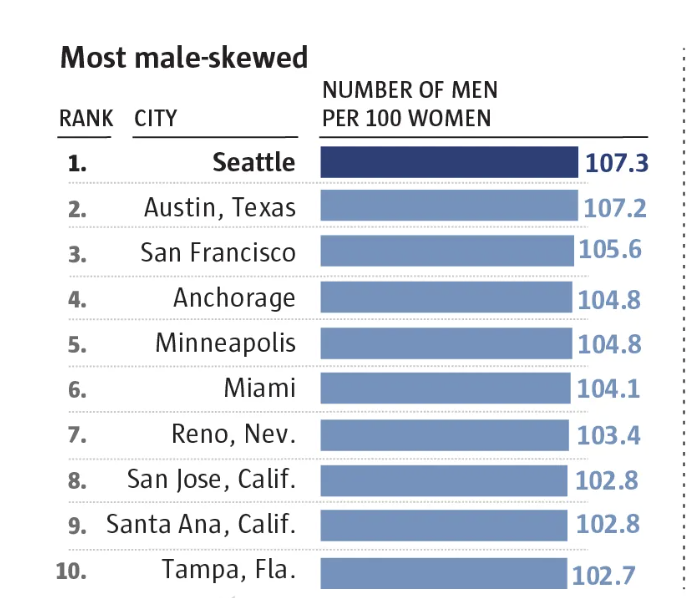

Finally, this article published back in June, illustrates the gender divide and how Seattle was ranked the most male dominated big city within the country! For every 100 women in Seattle there were over 107 men. Personally, I don't feel that's too big a gap, but was still surprised that it was enough to rank us #1 in the category. Fellas, if you're looking to find the big city where the number of women are most outweighing men, check out Baltimore that had roughly 100 women for every 82 men.

So what does this have to do with real estate? Well, perhaps nothing. Or maybe it's telling us something? If we combine each of these articles, it more or less fits into the narrative that your average Seattle area home buyer is a millennial male working in the tech industry. Below are AI generated images of these individuals. Maybe you've run into them at an open house?

Obviously, this is somewhat of an overgeneralization (and hopefully a comical one), but the basics ring true. Young-ish people with money are buying homes. Does that mean everybody who doesn't fit into this narrow demographic is SOL? Of course not. Personally, very few of my clients fit into this mold and everybody's situation is different.

What I do know is regardless of your financial situation, if you're looking to get started in your home buying journey for 2026, buckle up for a competitive start to the year. Every year we see competition peak in Q1 and early Q2 setting up a huge chunk of the overall appreciation for the entire year. What could add to the intensity this year is the declining mortgage interest rate.

Interest rates today are roughly a full point lower than they were at this time last year. Lower borrowing costs means stronger buyer purchasing power which push home prices higher. You heard it here again. Buckle up!

Onto the stats:

Seattle: The median sale price in December 2025 registered $914,000. That was up 1.7% YoY and down from $973,500 in November. Inventory was up 28.6% YoY while the months of inventory dropped to 2 months from 2.65.

Eastside: The median sale price registered $1,500,000. That is down 2.9% YoY, but up MoM from $1,430,000. Inventory remained relatively ballooned at 64.7% more homes on the market YoY, but the months of inventory significantly decreased to 1.58. months from 2.41.

King County: The median sale price registered $899,950. That is up 2.9% YoY, but down MoM from $915,000. Inventory was up 34.6% YoY while the months of inventory statistic dropped from 2.31 to 1.68 months.

Those months of inventory stats are a foreshadowing into the competitive Q1 and early Q2 market. Dust off your boxing gloves, for certain properties, it's going to a bloodbath out there. Don't say I didn't warn you

And finally, I'm hosting the first Home Buying seminar of 2026 including a FREE brunch at Ivar's Salmon House in North Lake Union. The event is Saturday, February 7th, from 10-11:30. If you'd like to come, please use this link to RSVP. If you know of anybody else who'd benefit from this info, please send their way!

Onward!