A Buyer's Market to Start 2026. The GSMCR for January, 2026

I hope you've been properly celebrating your 2026 Super Bowl champion Seattle Seahawks!!

Back to business and welcome to the latest Seattle Condo Market Review. As always, to jump right to the stats, you can watch that video by clicking here. For more detailed information, continue reading below!

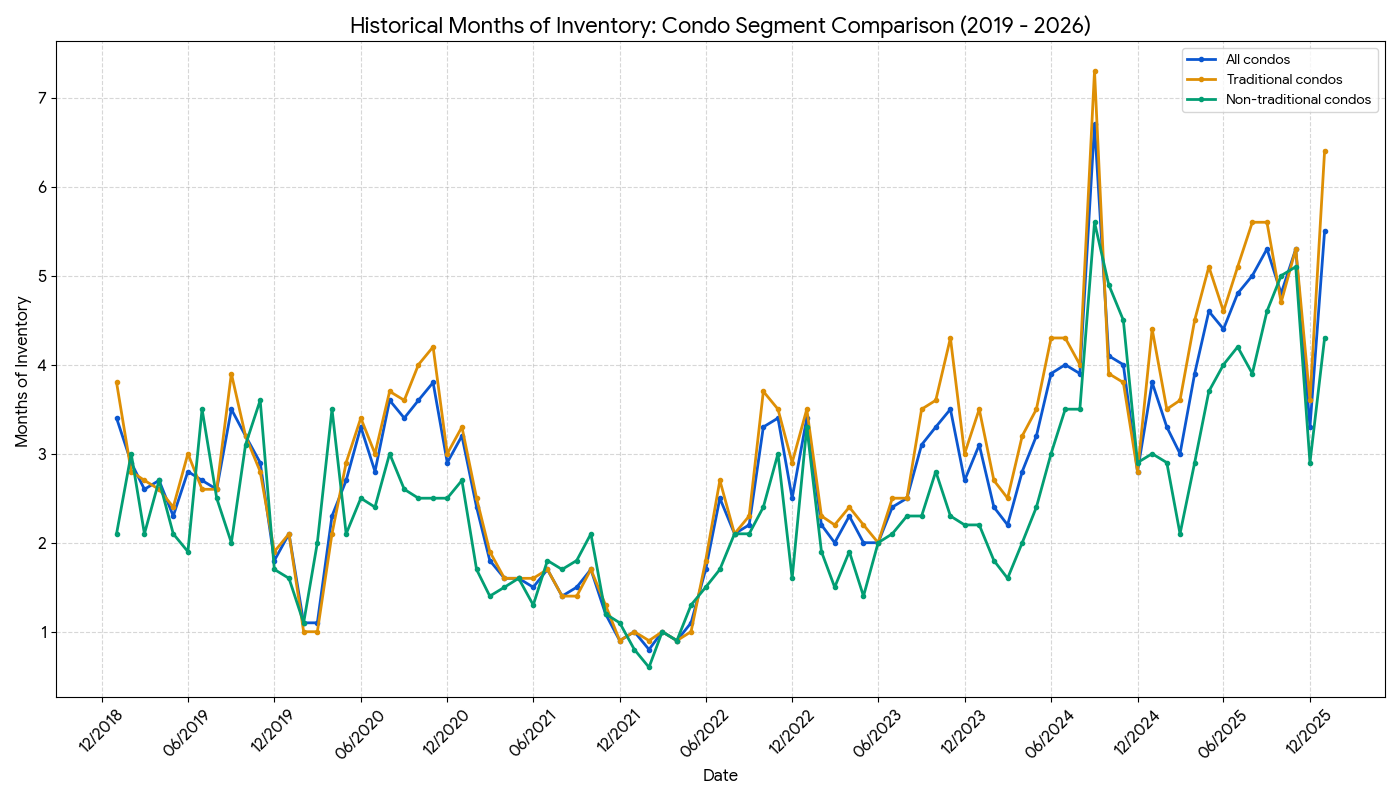

I apologize for the above chart not being the most visually easy to read, but regardless, what I want to highlight is this: We're entering the year already in a buyer's market for Seattle condos.

it's true. The blue line represents all condo types, the orange line represents traditional condos (one story), and the green line represents non-traditional condos. The latter are going to include the new construction condos we refer to as condo-ized homes or DADU's.

A neutral housing market is roughly 3-4 months worth of inventory. Late Q4 and early Q1, historically, represent the lowest levels of months of inventory because overall inventory is much less compared to the summer and fall months. For the entire condo market to start the year at over 5 months of inventory is definitely NOT what I was wanting to see if 2026 was going to offer relief for the condo market. Of course, we have a LONG way to go so I'm not putting a fork in the condo market just yet. That being said, we're working off quite the deficit.

At least nationally, mortgage applications from borrowers looking to purchase are at their highest levels in 3 years. It's a small victory. Not one that will save the local condo market, at least not any time soon, but it's a start. I still feel the best friend for the Seattle condo market moving forward will be the decline of new apartment construction though I don't expect that impact to start making a difference until next year at the earliest. Perhaps more on that later in a future edition.

Onto the stats :

The median sale price for a Seattle condo in January registered at $557,000. That is down 19.3% YoY and up, just barely, MoM from $555,000. Inventory remains elevated with 21.6% more units on the market YoY. The months of inventory statistic increased significantly YoY to 5.39 months from 3.02.

I hope you all properly celebrated the Seahawks Super Bowl victory! Below is a picture a colleague of mine found. Sadly, despite this person having a striking resemblance to me, I can confirm this is not me. But I can assure you we shared the same spirit that day. Go Hawks!

Onward!

Buy the Dip? The GSHMR for January, 2026

Welcome to the latest edition of the Greater Seattle Housing Market Review. As always, to skip right to the stats, click here. For more information, continue reading below!

As the title suggests, January produced some pretty sluggish numbers for a number of different metrics. And as I've reported on in the past, this is the "dip" before the market begins to take off. See my report here I wrote just a few months ago on this topic.

However, while January every year is a step back before taking multiple steps forward, 2026 started off with more of a setback than what we're used to seeing.

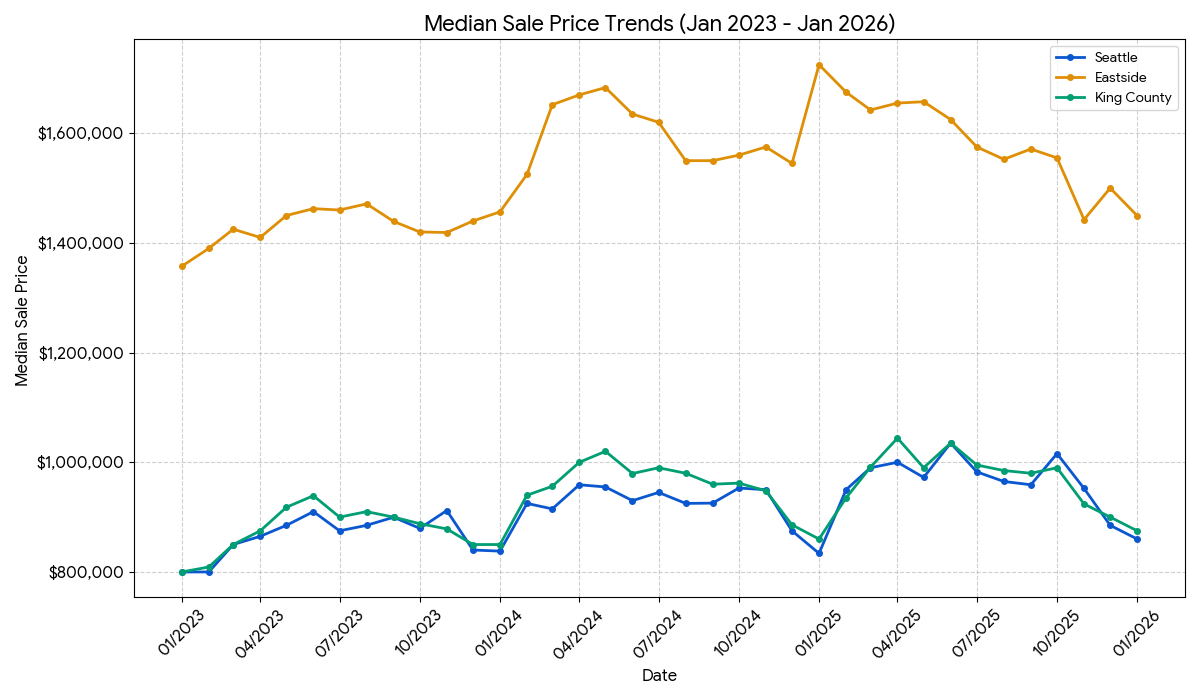

Starting with the median sale prices, Seattle saw the lowest median sale price ($850,000) since December of 2023. The Eastside ($1,435,000) wasn't this low since November of 2023 and King County as a whole ($850,000) wasn't this low since January of 2024.

While the absorption rate for Seattle was the highest it has been since July, it was still the lowest January reading since I've been collecting this data going back to 2019. Additionally, it wasn't even close with buyers absorbing inventory at roughly 25% less than January of 2025.

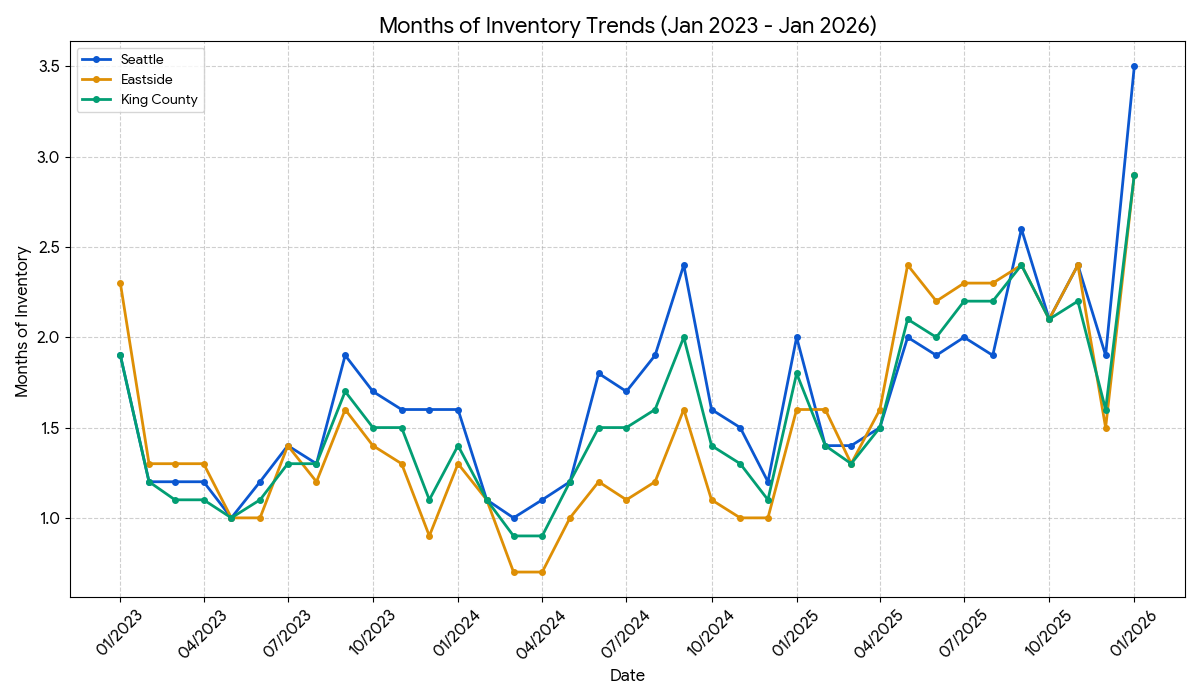

What surprised me the most was the months of inventory. Typically, January is one of the lowest points in the year for this metric as inventory is always slow to pick back up after a dormant end to Q4. Surprisingly, this number increased for each area month over month and was up quite significantly year over year.

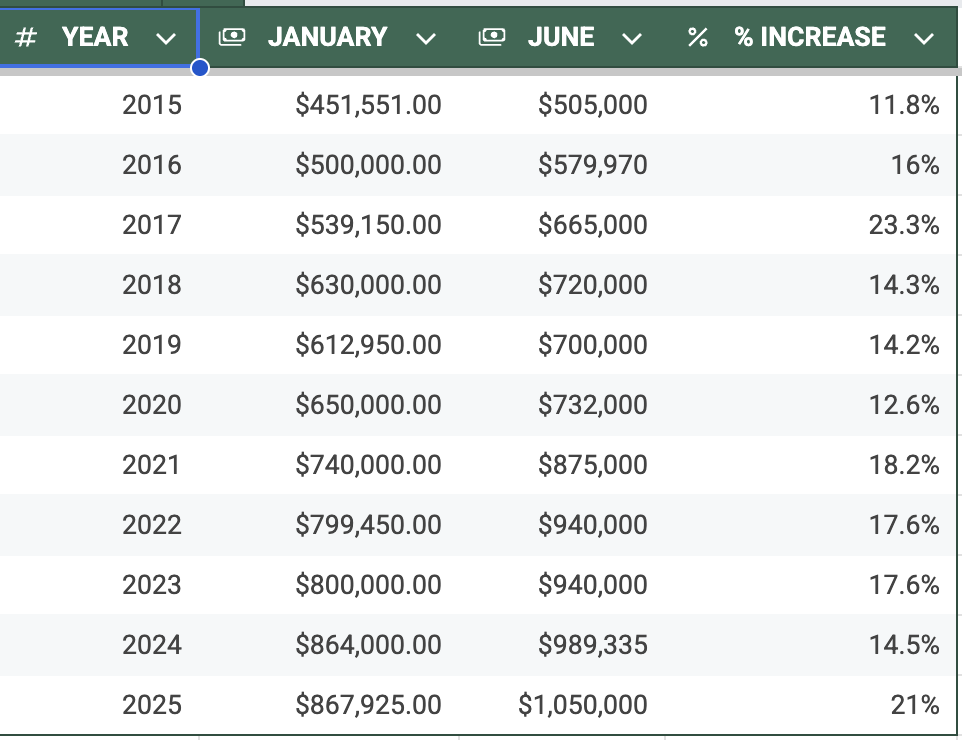

The graph below I used in a report about 3 months ago to show how, every year, January represents the low point for property values before they take off in the next 4-5 months. (This was for King County)

Given what we've seen the last 10 years (and beyond, I chose not to include any more history for the purposes of keeping this as succinct as possible) we're just getting out of that "dip" before values historically begin to take off.

Does this mean buyers have missed the boat? No, not at all. Some of the reason as to why values in January are depressed relative to the rest of the year is because much of what's selling in January was listed in October, September, August, etc and thus sat on the market for a few months, had one or more price reductions, and overall sold under the asking price.

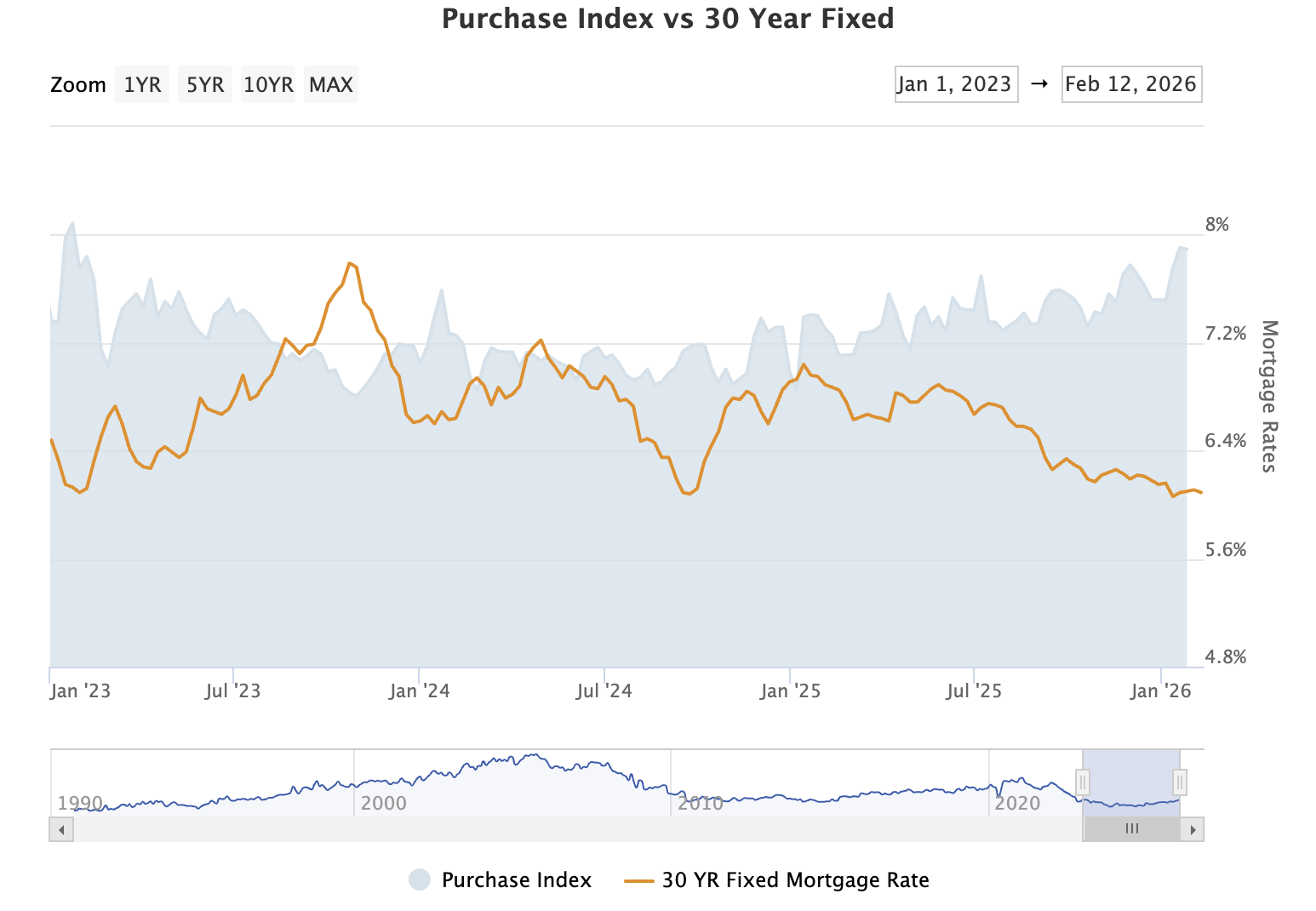

What I'm seeing anecdotally right now suggests the opposite as multiple offers are back. I've even seen a few cases where properties that had been sitting on the market dormant for 70+ days suddenly received multiple offers. Perhaps some of this can be attributed to the graph below:

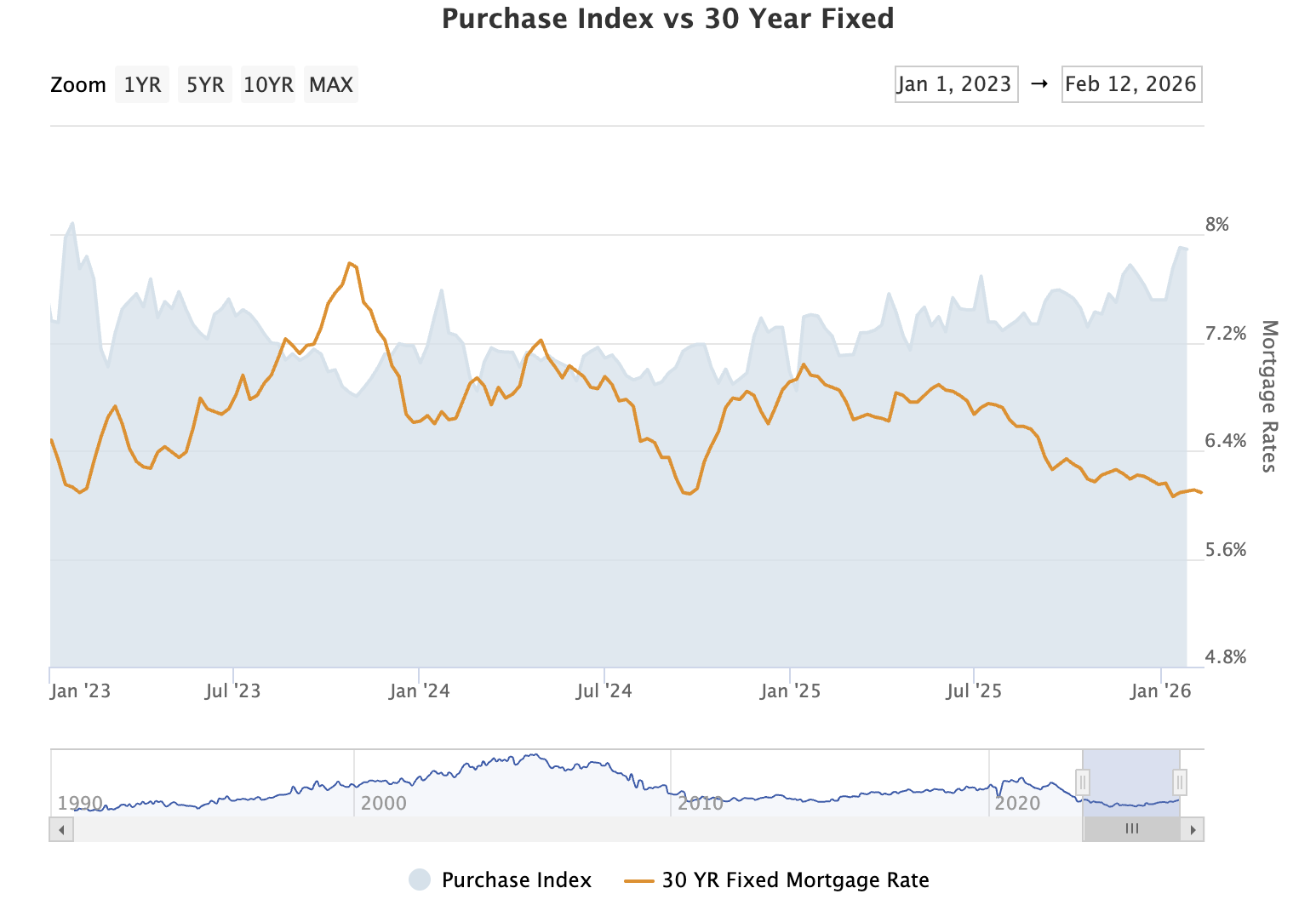

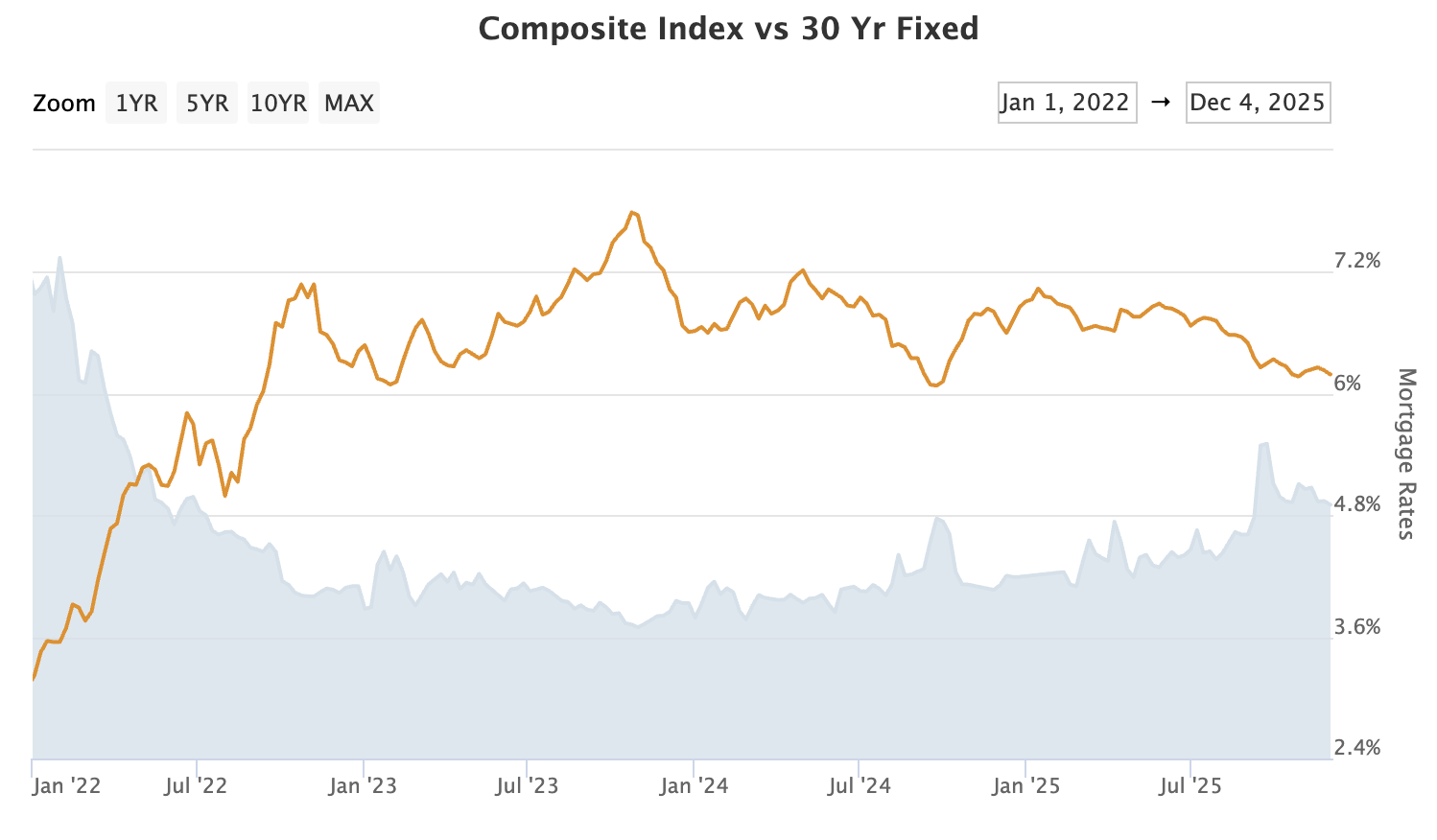

Above, in the dark shaded data, is the purchase application index that tracks national purchase applications for mortgage applicants. This January we reached levels we have not seen since January of 2023.

Before we throw any parades, let's keep in mind that these figures are still roughly half of what application rates looked like during the post Covid bubble (see above). Still, there's hope that this might signify we've passed the bottom and are on our way out of the housing recession we've been in for almost 4 years. More buyers applying for mortgages is a pretty obvious precursor to more homes being purchased, right? Time will tell.

Onto the stats: A little anticlimactic since I already discussed these, but nevertheless, here we go!

Seattle - January 2026 median sale price of $850,000. that is down .87% YoY and down from $914,000 MoM. Inventory was up 29.9% YoY and the months of inventory statistic increased dramatically MoM to 3.39 from 2 months.

Eastside - Median sale price of $1,435,000. That is down 16% YoY and down MoM from $1,500,000. Inventory remains elevated at 49.34% more homes on the market YoY and the months of inventory rose to 3.17 from 1.58 in December.

King County - Median sale price of $850,000. That is down .58% YoY and down MoM from $900,000. Inventory is up YoY b 31.13% and the months of inventory rose to 2.92 from 1.68.

I hope you all properly celebrated the Seahawks Super Bowl victory! Below is a picture a colleague of mine found. Sadly, despite this person having a striking resemblance to me, I can confirm this is not me. But I can assure you we shared the same spirit that day. Go Hawks!

Onward!

Stale rents = paused buyers; The Seattle Condo Market Review for December 2025

Happy New Year!

And just like that we're into 2026 and 1/4th of the way through the 21st century. Wild!

Welcome to the latest edition of the Seattle Condo Market Review. As always, to jump forward straight to the stats, you can do so by clicking here. To get deeper context into everything Seattle condo related, continue below!

For those of you who have been consistently reading these reports over the years, you're probably well aware of the challenges I've had in trying to report on something new month after month in a market that's been so, well, challenging. I'm going to come right out and say it, I don't think 2026 is going to be any different. I hope I'm wrong.

What does it take to get a home sold? It takes a listing (supply) and demand (a buyer). I know, duh, a real brain buster of a question. We know that inventory/supply has not been kind to the condo market for the past year and beyond, but we also know demand has been oppressed too thanks to affordability challenges with increasing mortgage rates, insurance costs, HOA dues, etc. However, I want to explore a less talked about challenge to getting condos sold. Flat rents and a significant disparity in the mortgage to rent ratio.

Historically, rising rents are the best incentive for buyers to kickstart their homeownership journey. Not because homeownership is less expensive than renting, but if the figures are close enough, it makes sense hedging one's housing cost and investing into real estate vs paying someone else's mortgage month after month. The problem the condo market is seeing right now is totally different. Renters are staying put because their rents aren't increasing AND the value of condo ownership hasn't produced the return on investment it did years ago.

I'm going to share some real life examples for condo owners who have reached out to me about selling, some who have had their units rented out recently, so I can directly convey these challenges in real time.

An owner of a Belltown studio was recently receiving $1,700/month in rent. It was a studio unit and I estimated it could sell for $260,000, or thereabouts. If a buyer were to purchase this unit at $260,000 and put 20% down while financing the home at 6%, the buyer's total monthly payment, including HOA's, would come out to $2034. As a consumer, would you rather pay $1700 or $2,034 AFTER dropping $50,000+ into a down payment?

Another Belltown condo owner, this time of a 1 bedroom unit is currently receiving $2200/month in rent. Their total mortgage + HOA payment was in excess of $2,600/month. So they were already losing roughly $400/month in negative cash flow. Yikes. I estimated that $350,000 would be a sensible price for this unit so with a 20% down payment, financing at 6%, all the same factors from above, that would equate to a monthly mortgage payment of $2,796/month. Roughly a $600/month difference, or 27%+ more to buy vs rent.

Moving outside of Belltown, a Queen Anne condo owner contacted me who currently has their unit leased for $3,000/month. Not bad at all for a 1 bedroom unit. The problem here is that this building has extremely high HOA dues of $1,493/month. Buying that unit today at $575,000 (which would be a little less than what the unit was purchased for in 2019) would equate to a total monthly mortgage payment (plus HOA's) of $4,851/month. 61.7% more than what the unit is currently rented for. Wow.

Don't get me wrong, the monthly payment has historically almost always been higher on a mortgage vs rent comparison so I'm not suggesting it only makes sense to buy when the numbers are close or when it's more expensive to rent. The problem I'm highlighting is when buyer's aren't seeing the value of the asset they're investing in AND they can rent the exact same unit for a fraction of a monthly payment vs owning, what's compelling them to pursue condo ownership? Especially with inflation staying elevated everywhere else, the ability to keep your housing costs minimized is likely paramount to many Seattleites.

Onto the stats:

The median sales price for a Seattle condo ended 2025 at $550,000. That is up .9% YoY and down MoM from $573,500. Inventory was up 13.8% YoY but the months of inventory stat declined significantly to 3.02 from 5.41 months in November. We also notched the highest absorption rate metric since March (likely due to all those units being pulled from the market in December).

Lastly, I'm hosting a FREE Home Buying seminar on February 7, 2026 at Ivar's Salmon House in North Lake Union. It's from 10-11:30 and if you'd like to come, you can RSVP here. If you know of anybody else who might be interested, feel free to forward to them.

I look forward to connecting more in 2026. Onward!

Fun With Demographics; The Greater Seattle Housing Market Review for 12/2025

Happy New Year!

And just like that, we are now 25% through the 21st century. Holy cow.

Welcome to the latest edition of the Greater Seattle Housing Market Review. As always, to skip the reading and jump right into the stats, you can do so by clicking here. For the rest of you, continue below!

As a Seattle Times subscriber, I've found the FYI Guy (Gene Balk) to consistently have some interesting articles. He's not the real estate beat writer for The Times, in fact his articles aren't ever about real estate, but it's not a stretch to find parallels between a few recent articles and the current, and future, outlook for our local housing market.

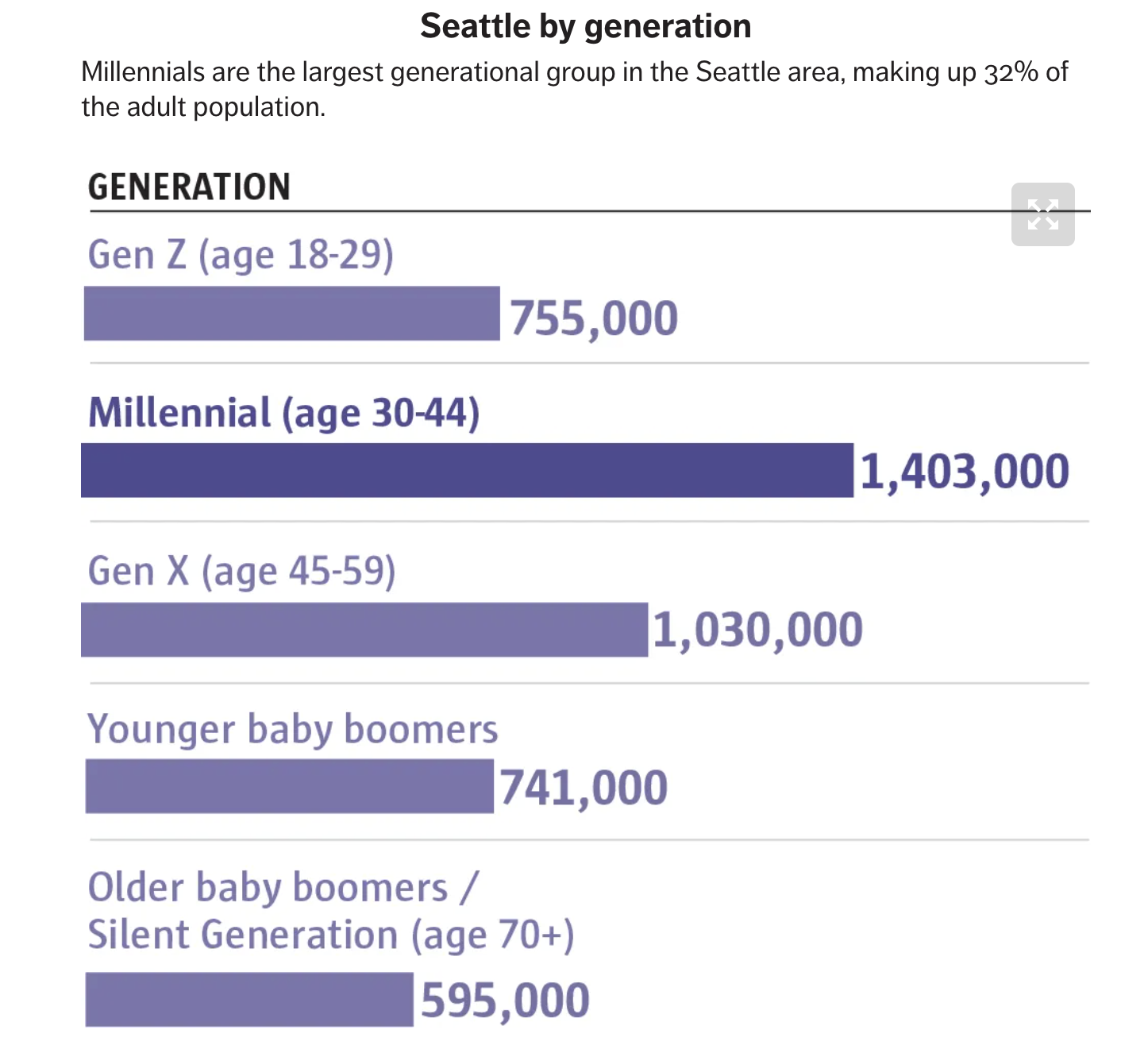

For starters, this story, published in mid December, identifies millennials as being the most populous generation in the Seattle metro area, accounting for over 1.4 million residents. This is largely due to the increase in millennials moving to Seattle during the 2010's while the local tech industry was on a hiring craze.

But what do we also know about millennials? We know that the median age of a first time home buyer has been increasing over the last number of years, finishing 2025 at 40 years old. There are many articles on this, but I'll link the article from NAR here.

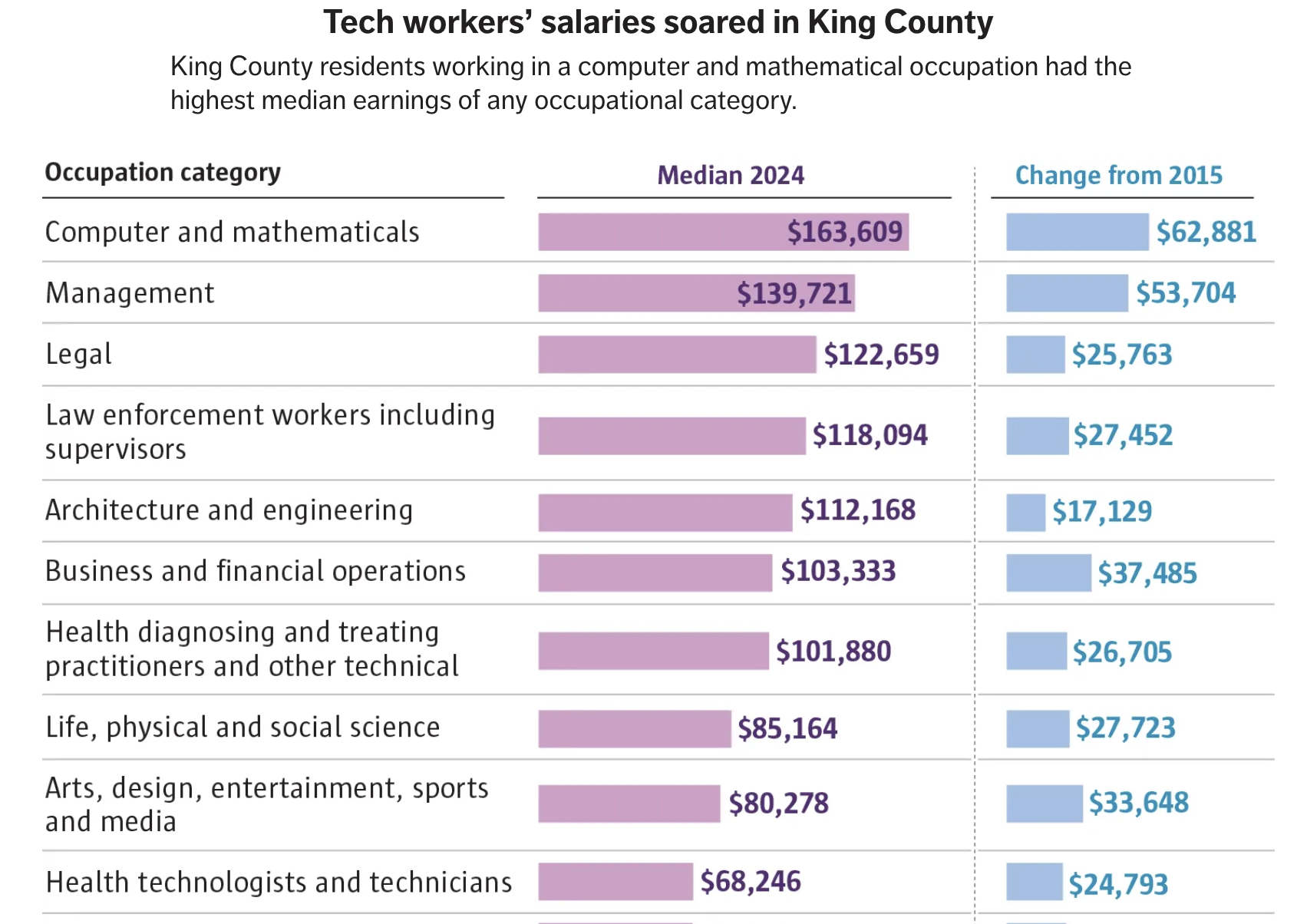

Circling back to tech, on December 9th the FYI Guy published this article, documenting the soaring pay within the tech industry over the past decade. See below the chart showing the gain in median incomes within different industries from 2015-2025.

Quick note; I'm always excited when they source data based around the median rather than the average since, especially with tech salaries, using the average could really swing the data dramatically. As a data nerd, I really like that and wanted to give a tip of the cap.

Another big take away I had in this article was the increasing pay gap within the tech industry. It's no secret just how male dominated the tech industry has, and continues to be, but it was surprising to see the gap between men and women actually increase from 2015-24. From the article, "in 2015 women in tech made 87.9% of what men earned. In 2024, that figure fell to 78.7%".

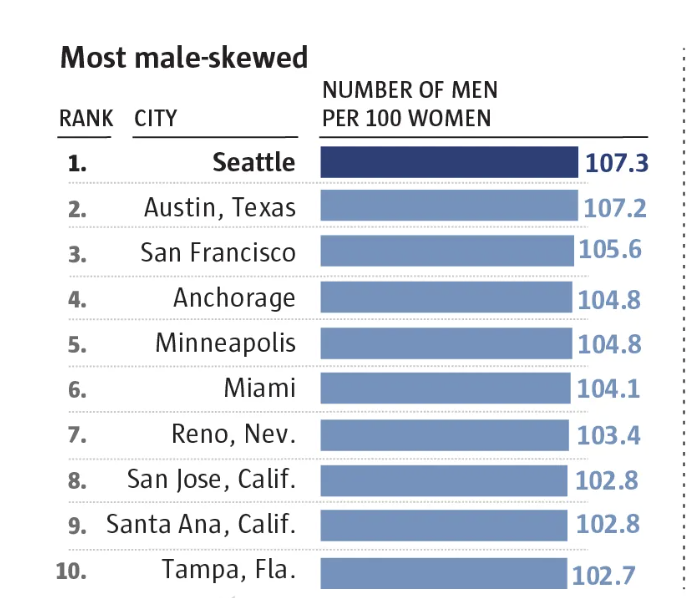

Finally, this article published back in June, illustrates the gender divide and how Seattle was ranked the most male dominated big city within the country! For every 100 women in Seattle there were over 107 men. Personally, I don't feel that's too big a gap, but was still surprised that it was enough to rank us #1 in the category. Fellas, if you're looking to find the big city where the number of women are most outweighing men, check out Baltimore that had roughly 100 women for every 82 men.

So what does this have to do with real estate? Well, perhaps nothing. Or maybe it's telling us something? If we combine each of these articles, it more or less fits into the narrative that your average Seattle area home buyer is a millennial male working in the tech industry. Below are AI generated images of these individuals. Maybe you've run into them at an open house?

Obviously, this is somewhat of an overgeneralization (and hopefully a comical one), but the basics ring true. Young-ish people with money are buying homes. Does that mean everybody who doesn't fit into this narrow demographic is SOL? Of course not. Personally, very few of my clients fit into this mold and everybody's situation is different.

What I do know is regardless of your financial situation, if you're looking to get started in your home buying journey for 2026, buckle up for a competitive start to the year. Every year we see competition peak in Q1 and early Q2 setting up a huge chunk of the overall appreciation for the entire year. What could add to the intensity this year is the declining mortgage interest rate.

Interest rates today are roughly a full point lower than they were at this time last year. Lower borrowing costs means stronger buyer purchasing power which push home prices higher. You heard it here again. Buckle up!

Onto the stats:

Seattle: The median sale price in December 2025 registered $914,000. That was up 1.7% YoY and down from $973,500 in November. Inventory was up 28.6% YoY while the months of inventory dropped to 2 months from 2.65.

Eastside: The median sale price registered $1,500,000. That is down 2.9% YoY, but up MoM from $1,430,000. Inventory remained relatively ballooned at 64.7% more homes on the market YoY, but the months of inventory significantly decreased to 1.58. months from 2.41.

King County: The median sale price registered $899,950. That is up 2.9% YoY, but down MoM from $915,000. Inventory was up 34.6% YoY while the months of inventory statistic dropped from 2.31 to 1.68 months.

Those months of inventory stats are a foreshadowing into the competitive Q1 and early Q2 market. Dust off your boxing gloves, for certain properties, it's going to a bloodbath out there. Don't say I didn't warn you

And finally, I'm hosting the first Home Buying seminar of 2026 including a FREE brunch at Ivar's Salmon House in North Lake Union. The event is Saturday, February 7th, from 10-11:30. If you'd like to come, please use this link to RSVP. If you know of anybody else who'd benefit from this info, please send their way!

Onward!

The Calm Before the Storm; The Greater Seattle Housing Market Review for November 2025

We've almost made it past 2025!

Welcome to the latest edition of the Greater Seattle Housing Market Review. You might have noticed I'm slightly changing the wording of the title to reflect the previous month, since that's the data I'm referencing, as opposed to the month in which I create the report. This is also designed to provide more consistency to the blog feature on my website (recently revamped, check it out). As always, to skip the good stuff and go right to the stats, click here.

I create this writeup every year at this time, probably even plagiarizing the title year after year. At this moment, the market is dormant. New listings have been virtually non-existent since the beginning of November, leaving the few buyers out there with not much to look at or choose from. The result is that the market limps to the finish line at the end of the year like a wounded runner crossing the finish line at the conclusion of a grueling marathon. However, thanks to historical trends we can set our watch to, we know we're currently experiencing the calm before the Q1 storm. And when that storm hits, watch out.

There are a number of factors that can potentially contribute to a more robust housing market in early 2026. Many of which I've discussed in the past (and will do so again), starting with one that I don't think gets much attention; increasing conforming loan limits.

Increasing Conforming Loan Limits: Every year, Fannie Mae and Freddie Mac adjust their conventional loan limits based on changes in local housing markets (these increase every year). They recently announced that in our area (King, Snohomish, and Pierce counties) the maximum 2026 conventional loan limit will be $1,063,750. That's the loan amount, not the price. Given that buyers can purchase a home utilizing conventional financing with as little as a 5% down payment, that means a buyer could purchase a home priced at $1,119,000, put 5% down, and qualify for conventional financing. Of course, they'd still have to financially qualify for this monthly housing payment, which wouldn't be cheap, but it's all possible. As conventional loan limits increase, that means buyers can qualify for conventional financing at higher purchase prices, which could push prices higher.

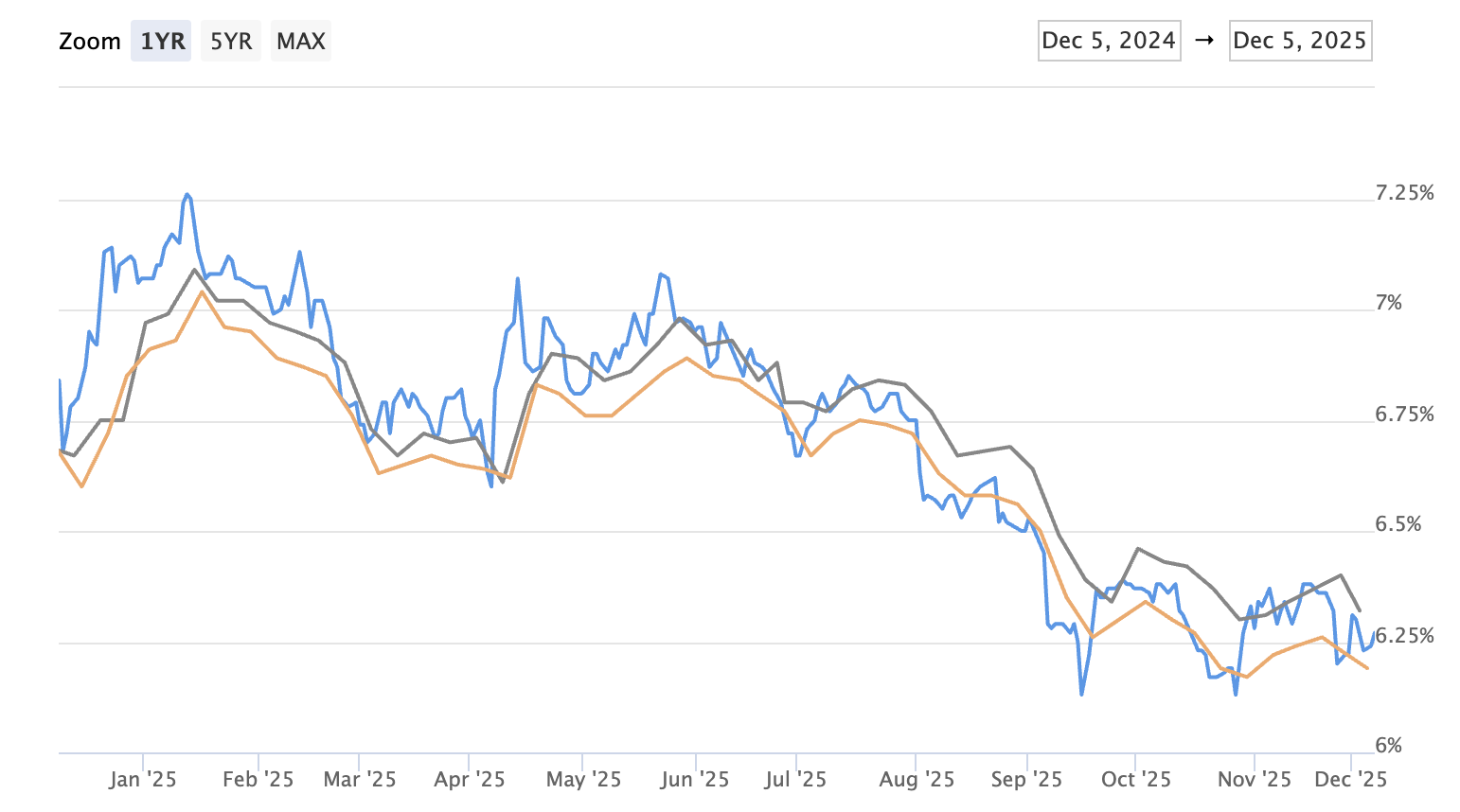

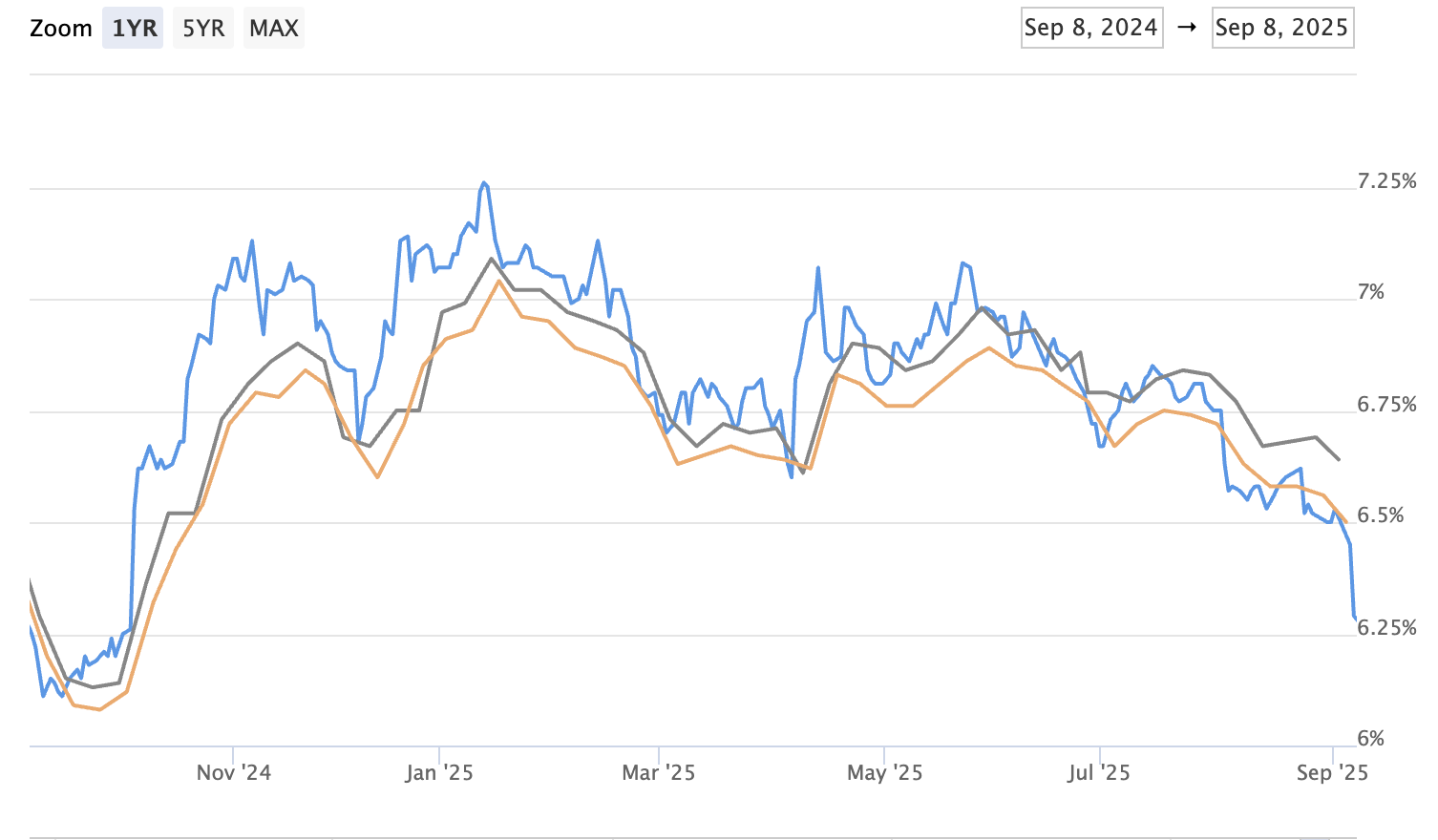

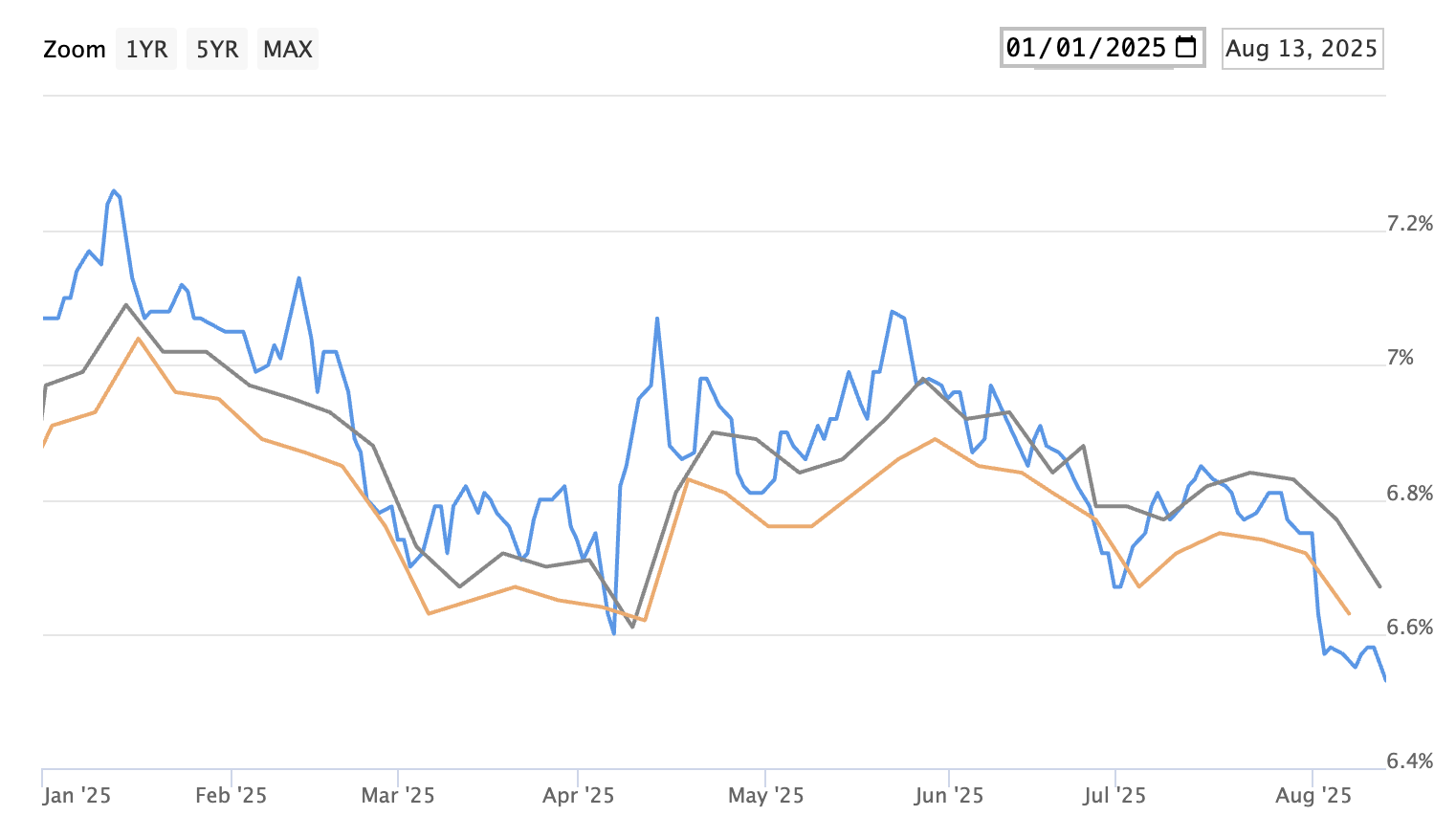

Steady, if not lower, mortgage rates:

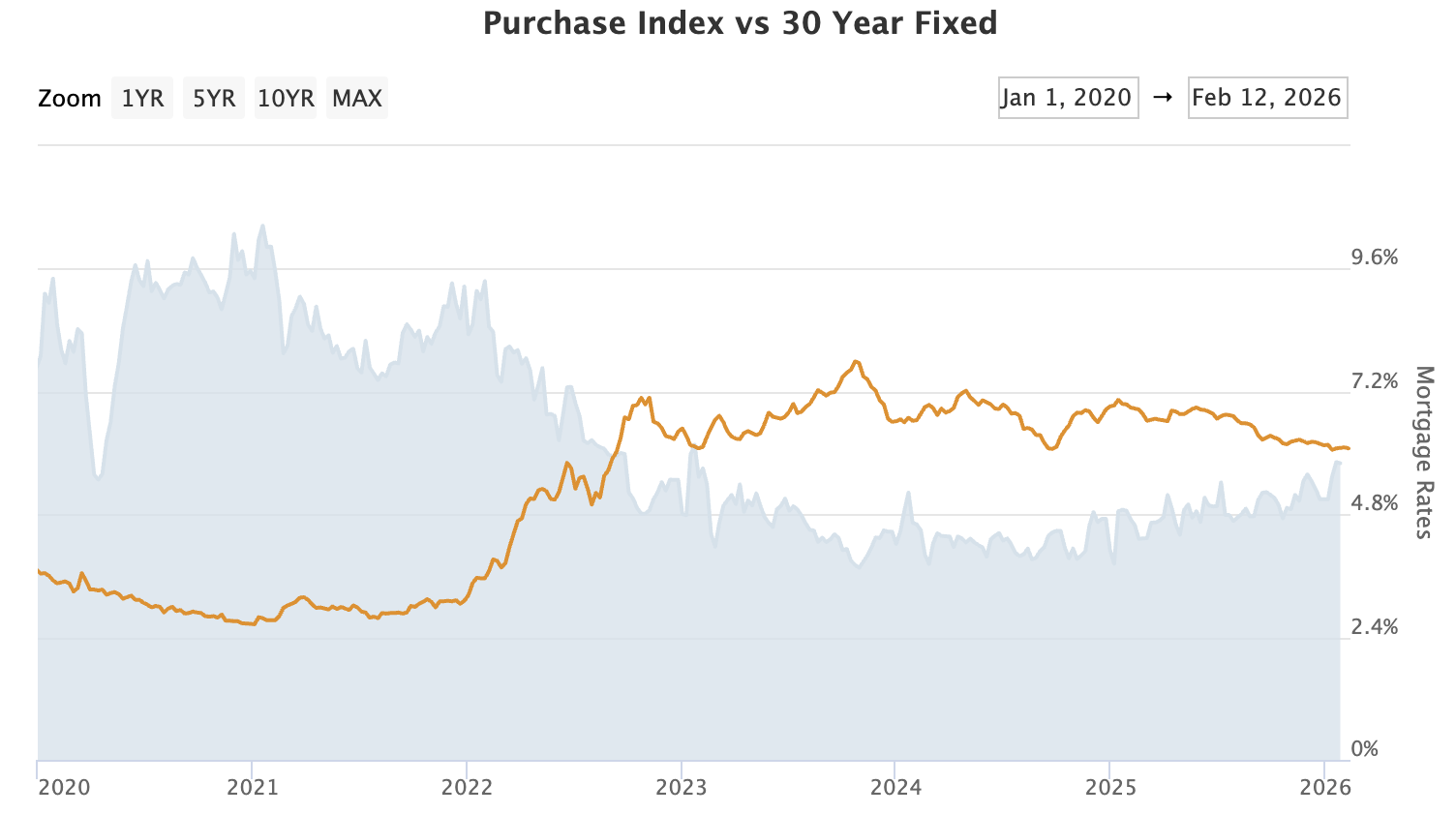

Look at how the 30 year mortgage interest rate has tread lower over the last year. It's not anything worth throwing a parade over, but they've come down .5-.75% during this time, which certainly helps from an affordability standpoint. Redfin recently published their 2026 housing outlook and they project interest rates to remain in the range in which we're currently sitting (low 6's). Personally, I feel that as long as mortgage rates are stable and not volatile where there are wild swings up or down, that stability creates consumer confidence, which brings more buyers into the market.

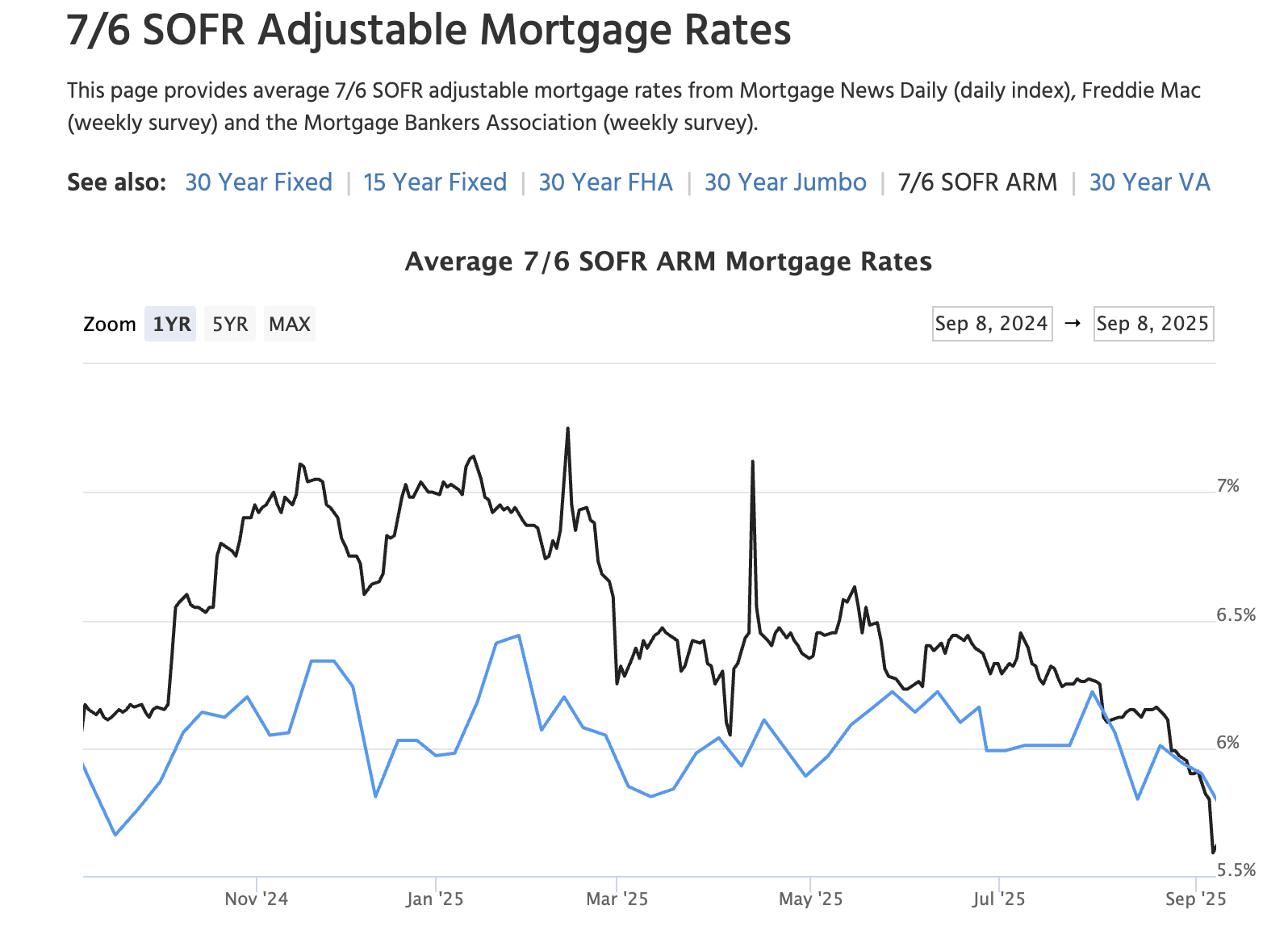

If rates not only stay where they're at, but actually trend lower, that could bring even more buyers into the market. A number to watch on this will be the unemployment rate. At the time I'm creating this report, the unemployment rate is 4.4%. The Federal Reserve has clearly shown their preference for labor data or inflation data in justifying interest rate cuts, but if the cracks within the labor market widen and turn into bigger issues, the Fed will feel increasing pressure to reduce their rate, which will send the 10 year treasury note below the current technical levels keeping mortgage rates in the low 6's. If this happens we could see rates in the high 5%'s (remember, the 10 year T-bill is what sets the 30 year mortgage, not the Fed funds rate). Of course, as discussed in previous reports, adjustable rate mortgages are already sub 6% so taking out an adjustable mortgage that's fixed for 7 or 10 years is more attractive than it's been in over a decade given the spread relative to the 30 year fixed. Lower rates could bring more buyers into the market, which can push prices higher.

Seasonality:

You're probably all tired of hearing me say this over and over again, but we have a very predictable housing market when it comes to seasonality. Thanks to decades worth of data, we know the first 4-5 months of every year are the most seller friendly. That is because of two things; low inventory and strong buyer demand.

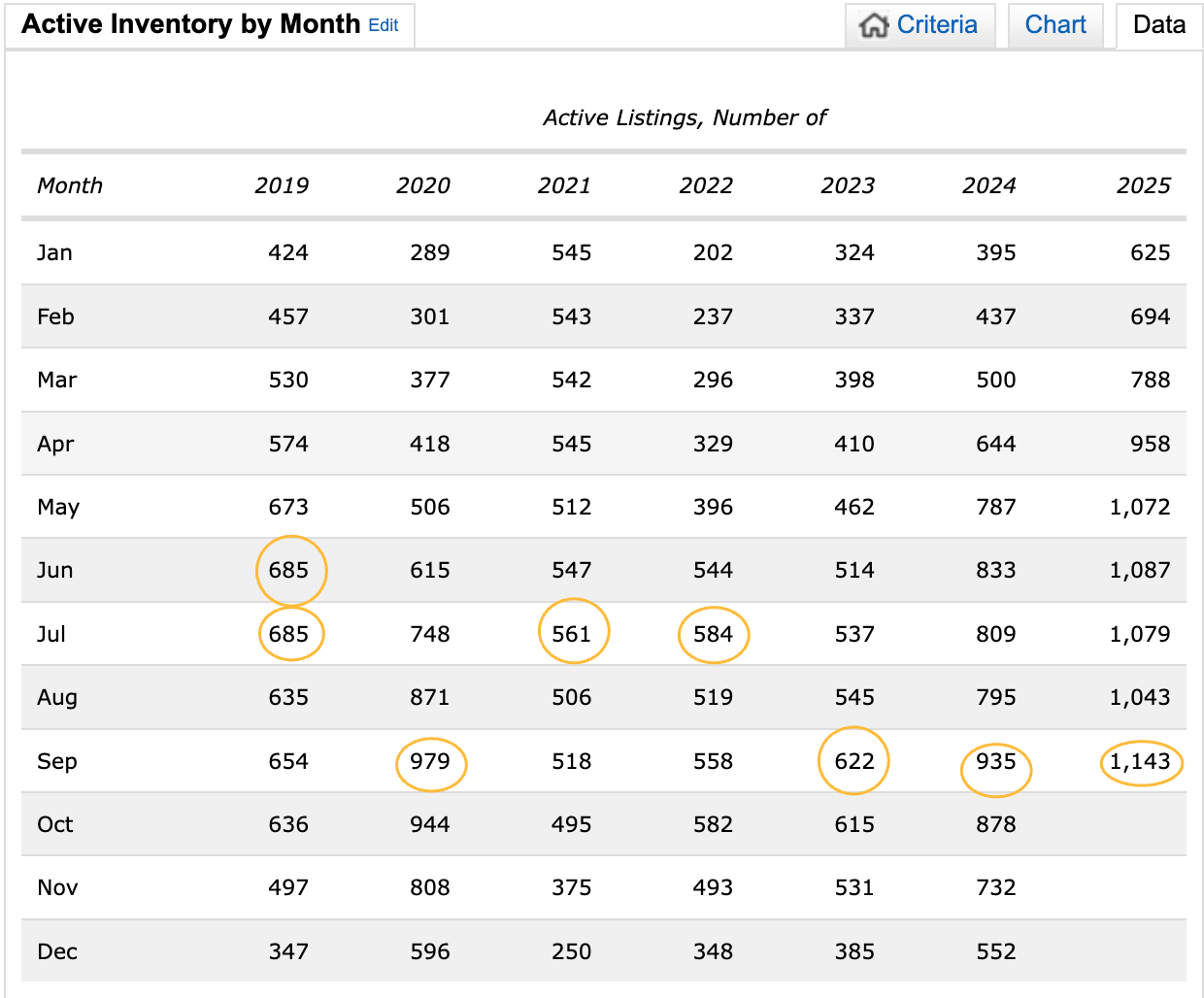

(King and Snohomish County active inventory chars above, respectively)

Inventory is always at the lowest point for the year every January. From there it builds throughout the year, peaking anywhere between July and October, depending on the year.

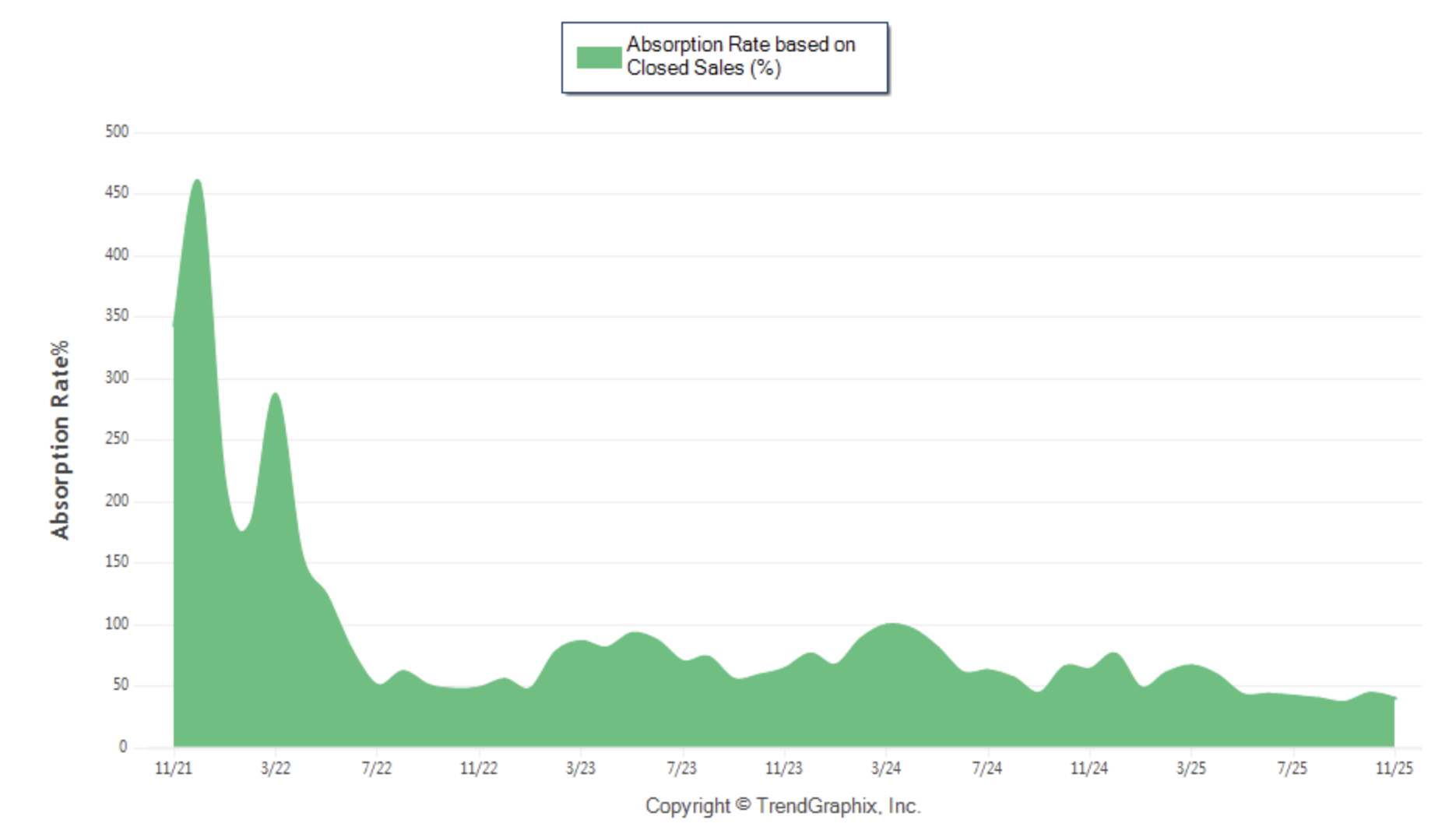

(Above) It's not the most obvious visual, but absorption is at its peak in the March-May timeframe of the year. Just look how insane the absorption was prior to the rapid interest rate increase during the summer of 2022.

Many of you are probably rolling your eyes because you've read or heard me preaching about this for years, maybe even experiencing it yourselves, but I'll throw one final curveball not yet discussed: new purchase mortgage application data.

Mortgage purchase applications are at their highest level since April of 2022.

While every Q1 and early Q2 are defined by low inventory, strong buyer activity, and sometimes fiercely competitive multiple offer situations, it's not crazy to suggest we might be in for a more intense, more seller friendly housing market than what we've seen in recent years. Buckle up!

Onto the stats:

Seattle: The November 2025 median sale price was $973,500. That is essentially flat YoY (up .57%) and down MoM from $1,050,000. Inventory was up 32.4% YoY and the months of inventory statistic actually increased MoM to 2.65 from 2.30. Seattle also set a new low (previous low was October 2025) for the lowest absorption rate since I've been tracking (2019).

Eastside: The median sale price was $1,430,000. That is down 7% YoY and down MoM from $1,550,000. In fact, November's reading was the lowest median sale price on the eastside since November 2023. Inventory is up 72.6% YoY and the months of inventory stat was flat at 2.41 months.

King County: The median sale price was $915,000, down 1.1% YoY, and down MoM from $997,000. Inventory is up 35% YoY and the months of inventory remained flat at 2.31 months.

Have a wonderful holiday season and enjoy time with your friends and family. We'll reconnect in 2026!

Wrapping up a Lackluster Year. The Seattle Condo Market Review, November 2025

We're almost through 2025! I hope your year has been fantastic and you're poised for an even better 2026!

Welcome to the latest edition of the Seattle Condo Market Review. You might have noticed I'm slightly changing the wording of the title to reflect the previous month, since that's the data I'm referencing, as opposed to the month in which I create the report. This is also designed to provide more consistency to the blog feature on my website (recently revamped, check it out). As always, to skip the good stuff and go right to the stats, click here.

As my reports have made painfully clear (I hope) over the past few years, the Seattle condo market has been challenging, to say the least. Thankfully, with help from myself and a few other real estate colleagues, the Seattle Times has done a solid job on reporting about this. You can read their most recent article (featuring me) here. If you can't get past the paywall, there's a similar article (though not featuring moi), here.

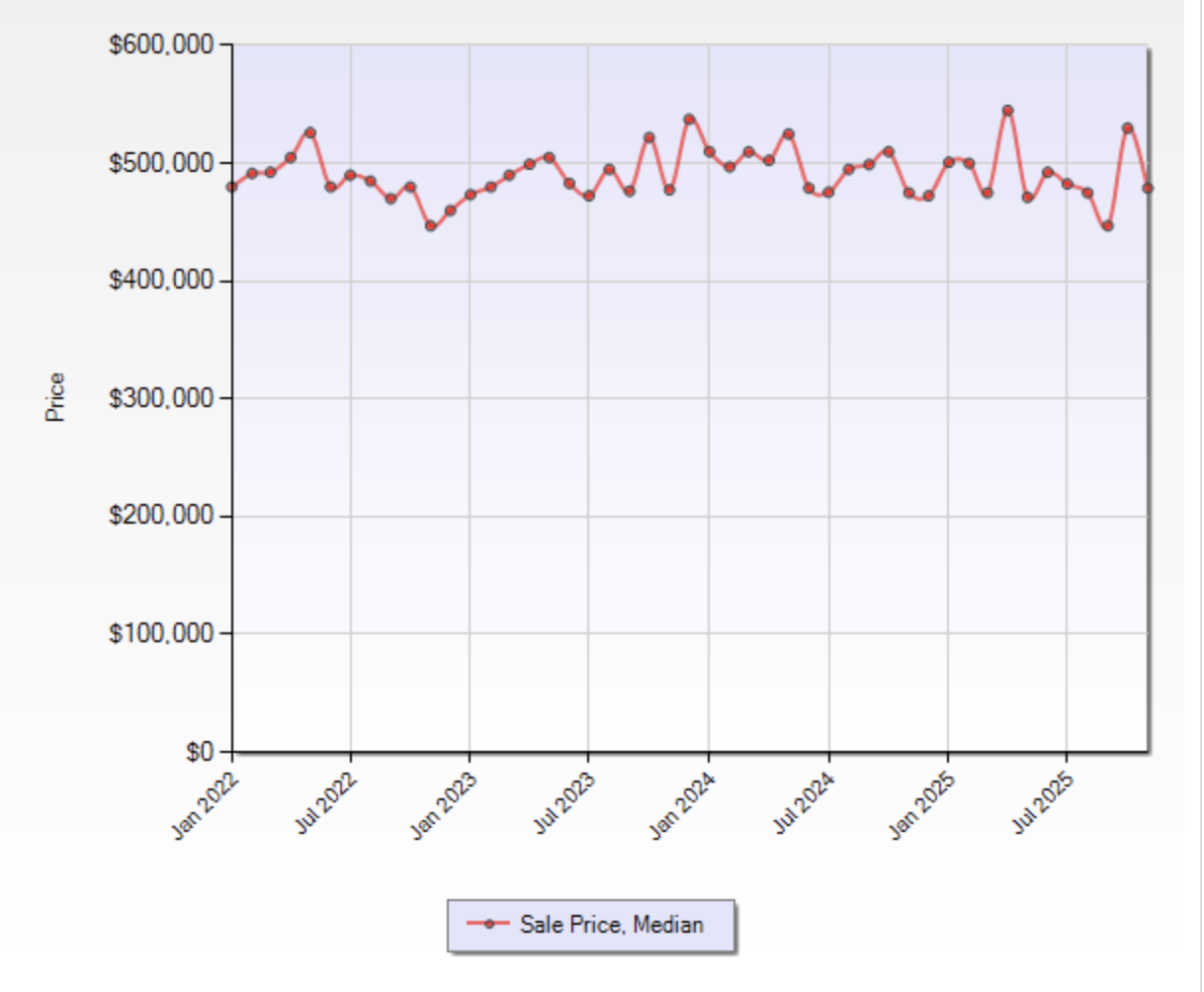

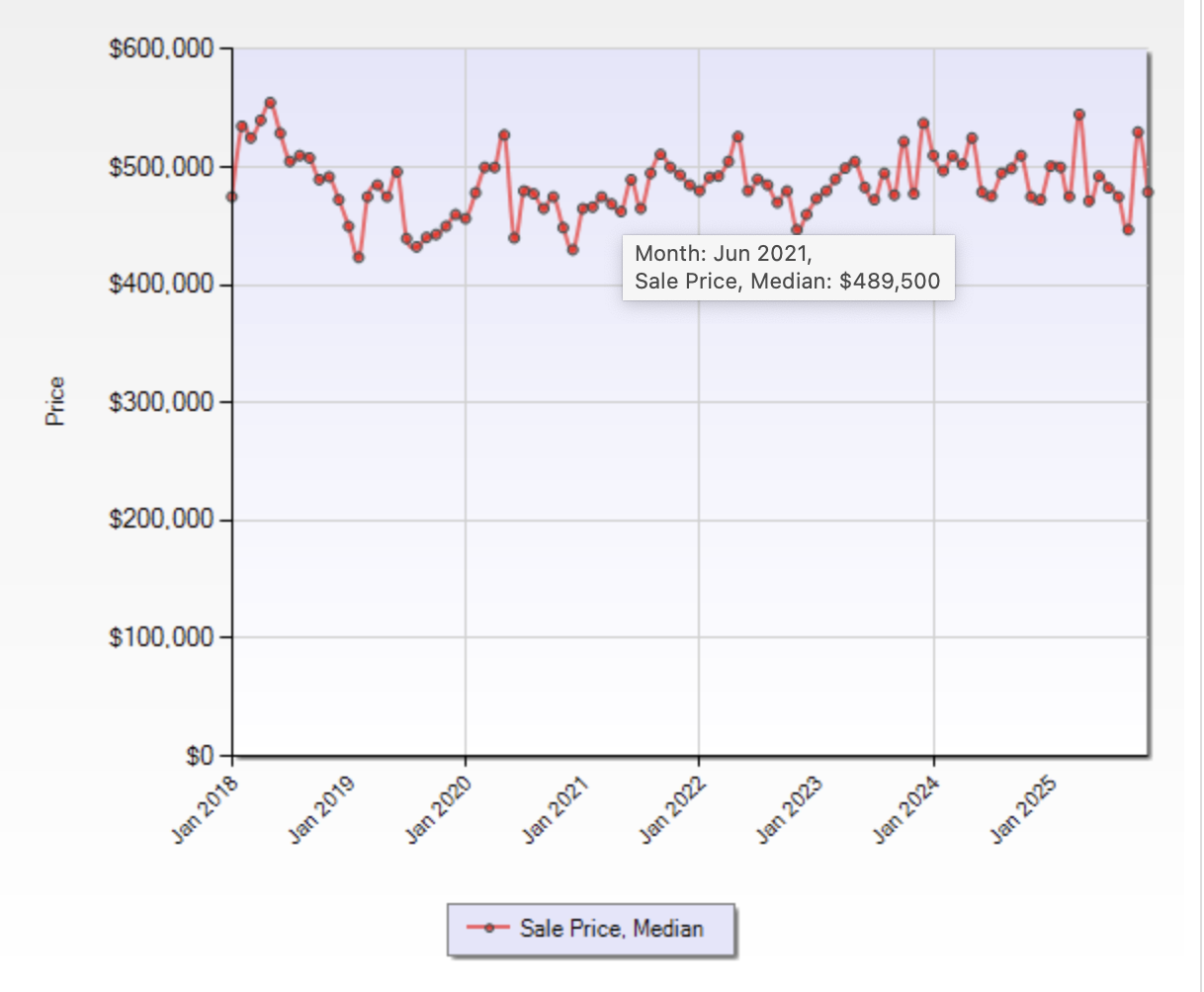

Above, I'm tracking the median Seattle condo (not including the newer construction DADU/condo-ized units) since January 2022. As you can see, the chart is very flat. I chose to focus on 2022 since it was in the middle of that year when we really saw interest rates start their rapid ascent.

However, even when I date this back to 2018, the data is still very much the same. Not great.

Redfin posted their 2026 housing market outlook. You can access that here, but it's not filled with any hot takes. Keep in mind, this is their outlook for the entire nation. In next month's report, I'll include my thoughts for the Seattle market in 2026.

Onto the stats: The November 2025 median sale price for Seattle condos registered $573,500. That is down just $1,450 YoY and down just $4,000 MoM. Inventory is up 20.8% YoY and the months of inventory stat increased to 5.41 months from 5.2. Absorption remains very poor.

That's a wrap on 2025! I hope you all have a fantastic Holiday season ahead. I'm looking forward to connecting with you in 2026. Onward!

Challenges with HOA's when buying/selling. The Seattle Condo Market Update, November 2025

Welcome to the latest and greatest edition of the Seattle Condo Market Update. As always, to jump straight into the stats, you can do so by clicking here. For those looking for more (and better) info, continue below!

As I've mentioned in previous reports, I struggle to find material for this report each month as the condo market has been so bland all year long. In this report, I thought I'd mix it up a little bit and discuss a variety of topics crucial to selling a condo in today's market. Bear with me.

Financial strength of HOA: Especially in markets like we're in right now, the financial health of an HOA is crucial in determining the marketability of a unit. What we're seeing right now is that there are lots of associations playing "catch up" because their dues have either been too low for too long, and/or for too long they've kicked capital improvement plans down the line. And while the rise in insurance premiums and taxes has caught every association off guard, those associations playing catch up have been disproportionately impacted. A great individual unit might warrant sufficient buyer interest, but that interest can completely evaporate if the association's financial health is poor.

Rules and Regs: Additionally, associations can deter buyers for reasons outside of their financial weakness. I'm referring to restrictive rules and regulations, specifically those that are restrictive in their pet and rental policy.

Seattleites love their dogs. Associations that don't allow dogs, expect a more difficult time in selling that unit and more time on the market. Associations that have weight policies on pets (25lbs and less) can also make it difficult, but at least offer something for dog owners. Cats seem to be acceptable everywhere. Pretty unanimously, most projects will have a 2 pet maximum. There's lots of variety when it comes to pets, just remember being excessively restrictive on dogs is not helpful in selling quickly.

Restrictive rental policies can also deter buyers. Generally homeowners like the flexibility of having the option to rent out their home if they move out, but aren't wanting to sell. Except, if the building has a restrictive rental cap policy in place, this can leave a homeowner in a real pickle. To be fair, I'm not aware or any condo building that doesn't have a rental cap policy in place so they're all restrictive to some degree. Most associations have a 25%-50% cap meaning no more than 25% or 50% of total units can be rented at one time. Some of the more challenging associations will have caps at 10% and it's not uncommon to hear of wait lists where there are homeowners waiting to rent out their unit when an opening becomes available. Imagine buying a unit in a low rental cap association and you get an unexpected job change. You can sell, but the market is really unfavorable, but you also can't rent the unit because there's a waiting list. What do you do? This is a real situation for many homeowners, unfortunately.

Non-warrantable: This is the term used to describe a condo association ineligible for conventional financing. In other words, Fannie Mae and Freddie Mac won't back any mortgages for these associations (of course, that means neither will the VA or FHA). Associations become non-warrantable for a variety of reasons. It could be financial (low reserves, special assessments in place or on the way) or something else like more than 50% of the units being rented, a single person owning more than 10% of the total units, the association being involved in litigation, etc.

The only options for owners selling a unit in non-warrantable buildings are either selling to a cash buyer or a buyer financing via a portfolio lender (a lender who doesn't sell to Fannie/Freddie). Washington Federal (WaFed) used to be the go to non-warrantable lender, but they exited mortgage lending in recent years. While there is a lender, somewhere, who can finance a non-warrantable condo, that stigma and limitations alone are likely to scare off a vast majority of buyers before they make it inside the unit.

Amenities: I'm not talking about a fancy gym, rooftop deck, pool, etc. I'm referring to basic amenities like in-unit washer/dryer and parking. Units not offering one, or both of these luxuries, are a much harder sell taking up more time on the market.

Given the above, I hope I've illustrated all the variables that come into focus when prepping a condo owner on the challenges they might face when preparing to list their unit for sale. The unfortunate part is that so much of this is outside the control of the homeowner. It's not as if we can just change a restrictive pet/rental policy, properly fund the associations reserve balance, or create parking where it previously never existed. Don't get me wrong, there's a buyer for any property at a certain price. The more challenges in place, the more the price needs to make up for those deficiencies.

Onto the stats: The median sale price for a Seattle condo for the month of October 2025 was $577,562. That is down .42% from last year and up MoM from $523,687. Inventory is up 12.9% YoY and the months of inventory dropped to 5.21 months from 5.45 in September. Absorption still remains at historically putrid levels though it was at the highest level since July.

Have an amazing Thanksgiving. Onward!

Stats, a 50 year mortgage, and layoffs. The GSHMU, November 2025

Welcome to another edition of the Greater Seattle Housing Market Update. As always, to skip straight to the stats, you can do so by clicking here. For more information not mentioned in the video, continue below!

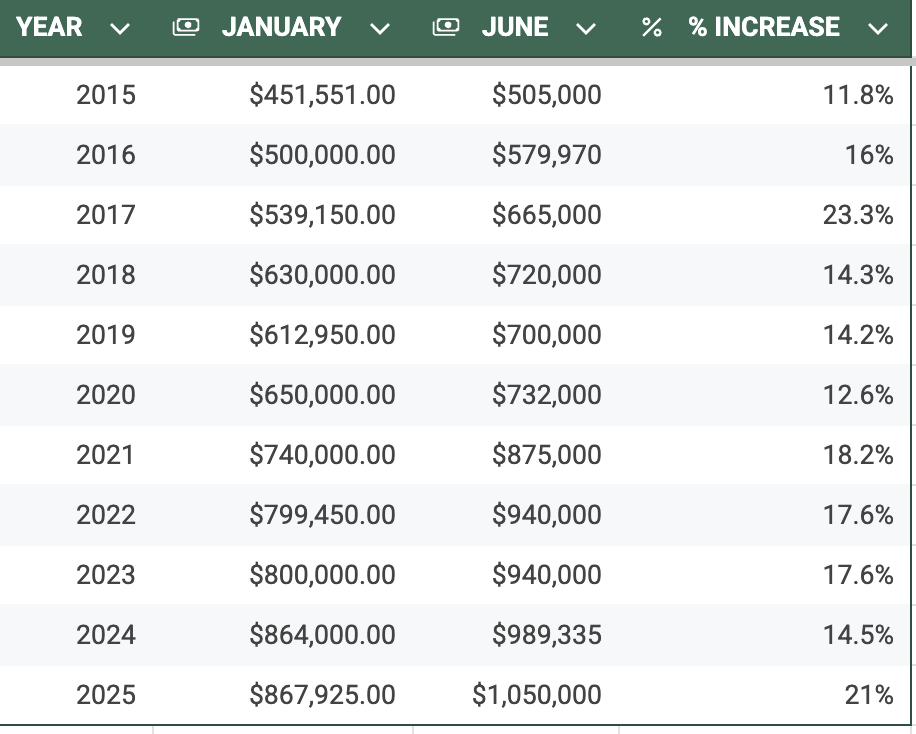

In past write ups, I've referenced seasonality in regard to inventory and buyer demand, but in this edition, I want to focus on Seattle home appreciation, specifically within the first 6 months of the year. Appreciation in our market almost takes place entirely within the first 6 months of every year. January is always the bottom point for the median sales price and then values gain, quite significantly, through the second quarter. In Q3 values stall a bit, and then at the end of the year they dip only to restart their upward trend a few months later once the new year turns over. See below the starting Seattle median sale price in January, June, and the percentage increase.

Below charts the relationship in a more viewer friendly version.

What does this mean? First, I'm never one to suggest "timing the market". It's about finding the right home, however long that might take. That being said, the sooner into the new year a buyer finds a home, the less, on average, they're paying. After being provided this information, buyers sometimes conclude that it's best to buy in Q3 or Q4 once values have stagnated or possibly even declined. There's no error in that thinking, but remember this; Pricing a home involves using data of recent sales. Setting a listing price for a home set to hit the market in Q1 means using data from similar sales that took place in Q4. Values decline at the end of the year, but buyer demand often pushes prices above their list price in Q1. On the other hand, Listing a home toward the end of the year involves using data from homes that sold when values were at their peak. 6+ months of appreciation leads to higher list prices. Even though demand isn't what it was earlier in the year and buyers might have leverage to buy the house under the asking price, that final sales price can still often be higher in August than what it would be in February. So just because the market conditions are more buyer friendly, that doesn't necessarily translate into getting the house any less expensive than what was possible earlier in the year despite more competition from other buyers.

Moving on. I'm sure you've heard that President Trump has floated the idea of creating a 50 year mortgage? If not, here's one of the many articles about this. Who knows how much bite there is to this idea, but I personally think it's a terrible idea.

It's true that a longer term mortgage would improve affordability, the benefit President Trump is touting, but that monthly savings would be negligible in the big picture. Don't forget, the longer the duration of the mortgage, the higher the interest rate. On an $800,000 loan, the 50 year option saves about $541/month, which is not insignificant, however the equity build up really slows down with a 50 year term. When you're paying so much in interest those first years, you don't start paying off significant amounts of principal until much later on in the amortization schedule compared to a 30 year alternative. In fact, over the life of the loan, the borrower taking out a 50 year mortgage ends up paying roughly $900,000 MORE in interest on this $800,000 example! See below:

Metric. 30-yr 50-yr Difference

Monthly Payment $5,096 $4,555 -$541

Total Interest $1,034,584 $1,932,989 + $898,405

I'm all for affordability, but not at the expense of equity. And certainly not at these proportions.

And finally, the elephant in the room, the recent layoff situation. First of all, I want to sympathize with those who have been impacted. My purpose isn't to diminish what any layoff might mean for their personal lives and situations. Instead, I'm going to attempt to offer a headline alternative away from the doom and gloom sensationalism. The below is an excerpt I pulled from a lender contact of mine, Kyle Bergquist of Cross Country Mortgage.

"...I do want to discuss what happened (recently) in the context of its potential impact on our Puget Sound Housing Market. Here’s the thing: The health of a local job market is absolutely imperative to the health of the local real estate market. Simply put: A strong job market drives demand for housing – it attracts new residents, and good wages can help a housing market gain value. With that said, we all know the inverse is also true – A bad job market is bad for housing. And if you were just rolling with the (recent) headlines, well, you’d think Seattle’s local economy was about to become a zombie graveyard.

Here’s the thing with corporate layoff headlines: Amazon HQ1 is here in Seattle (and HQ2 in Bellevue) so we immediately think doom and gloom when we see a headline stating 30,000 corporate layoffs. But did you know that Amazon has over 350,000 corporate employees worldwide?!? Only 64,000 of those corporate employees are here in Puget Sound (50,000 in Seattle, 14,000 in Bellevue). So obviously the number isn’t going to be 30,000 HERE in Puget Sound - It’s up to 30,000 worldwide…or 14,000 worldwide?... I don’t know what the actual number is anymore, but I do know it’s only 2,303 layoffs here in Puget Sound.

Again, really terrible for all those employees – I don’t want to take that away from them; BUT if we’re looking at this purely through the lens of how this might impact our local housing market, then it’s important to know that most employees who were affected will have 90 days to look for a new role internally. During that time, Amazon recruiting teams will be prioritizing internal candidates, and according to Amazon’s job board, there are currently 11,048 open jobs posted. Why doesn’t the media talk about that more?

The headlines we don’t get are how many people were hired in any given month. We get all the bad news, with very little good news."

While definitely unfortunate, I don't believe these layoffs are the fuse that's going to set off a firework of declining home values. Anecdotally, I have buyers experiencing massive competition for certain homes in certain areas well above $1,000,000. As I've (hopefully) made clear in past reports, property type and location are returning to paramount importance when buyers are home shopping.

Onto the stats:

Seattle: In October, the median sale price for a Seattle SFR was, $1,049,999. This is the second highest median sale price of all time! This was up 8% YoY and up MoM from $975,000. Inventory was up 21% YoY while the months of inventory decreased to 2.3 months from 3.08 in October. Watch for falling months of inventory over the next few months! Also interesting is that the absorption ratio registered the LOWEST figure ever recorded in the 6+ years I've been keeping track. Low absorption yet a 2nd all-time high sale price? It seems counterintuitive.

Eastside: The median sale price was $1,550,000. That is exactly the same it was a year ago and down slightly MoM from $1,575,000. Inventory is still up significantly at 76.4% more homes on the market, but the months of inventory reduced to 2.39 months from 2.79.

King County: The median sale price was $997,000. That is up 3.9% YoY and up MoM from $957,000. Inventory is up 33.1% YoY and the months of inventory decreased to 2.29 months from 2.76 the month prior.

Have an amazing Thanksgiving! Onward!

Seattle Condo Market Update — September 2025

Seattle condo prices hit a 2.5-year low in October as inventory stayed elevated and days on market stretched—giving buyers leverage before holiday listings tighten.

Happy Fall!

And welcome to the latest and greatest Seattle Condo Market Update. If you don't want to read and would rather watch, feel free to skip straight to the full YouTube video update here.

Good news and bad news for Seattle condo buyers

There was good news and bad news with September's stats for the Seattle condo market, depending on your perspective.

Ok, I'll give it a try. The good news is that sold inventory was up 45.2% YoY. 196 units sold in September of this year vs 135 units the month before. And YoY inventory is at its lowest mark (up 13.9%) year-to-date. In other words, inventory has been up YoY all year, it's just up at the smallest amount YTD.

However, the bad news is that the more sales resulted in lower sale prices. In fact, the median sale price for a Seattle condo in September registered the lowest amount ($523,687) since February of 2023. More sales, declining inventory, yet lower sales prices? Intuition would suggest the opposite, yet here we are. The optimist in me hopes this is the bottom and it's only up from here.

Why neighborhood matters for Seattle condo prices

Of course, the market is not a one-size-fits-all market. Geography plays a HUGE role in determining the expectations for sellers and I've reported A LOT on that in the past few months. For example, the months of inventory for Northwest Seattle (think Ballard, Greenwood, Green Lake, Fremont, Wallingford, etc) is 2.83 months. Contrast that to the Downtown/Belltown market of 6.71 months and you can see how important geography is.

Of course, the new construction backyard DADU's that you find in North Seattle don't exist in the downtown area so that also contributes to the vast difference since those are more desirable than units in high rise downtown buildings.

What inventory trends are telling us in 2025

Interestingly, over the last two years, and so far YTD, September has been the month of the year that's had the most inventory available. July is also well represented, too. We'll see if October can dethrone September.

Showing activity and what we’re seeing

Off topic, but something pretty cool that I just discovered. Our NWMLS has come out with a new tool tracking the amount of showings through the Supra keybox network. Granted, this data is across the entire NWMLS so there's no way for me to break this down into more microscopic data (county, cities, property types, ec), but it's interesting to see activity show exactly what we have been experiencing.

Despite more inventory growing during this time, showing activity decreases until after Labor Day, where it then picks up for two weeks, before declining again. But showing activity is up from last year, so that's good news (below). Again, not really tied to anything, I just found that interesting :)

Key Seattle condo stats for September 2025

Onto the stats:

The median sale price (as previously mentioned) for a Seattle condo in September 2025 was $523,687.

That is down 13.6% YoY and significantly down MoM from $595,000.

Inventory is up 13.9% YoY, and the months of inventory rose to 5.45 months from 5.18 the month prior.

Have an amazing Halloween. Onward!

Watch the full Seattle condo market update

Want more details? Watch my full Seattle condo market update video on YouTube for September 2025.

Seattle & Eastside Real Estate Market Update — September 2025

Seattle’s median slipped to $975K with inventory near 3 months, giving buyers more breathing room; the Eastside held around $1.58M—sellers should price and present strategically.

Welcome to October!

And welcome to the latest edition of The Greater Seattle Housing Market Update. As always, to skip the good stuff and go straight to the stats video, you can do so by clicking here. But for deeper reporting, continue reading below.

It's election season! At least it is in Seattle, where our mayoral election is set to take place next month. Incumbent Mayor Bruce Harrell is hoping to best challenger Katie Wilson and one of, if not the hottest issue on the minds of voters, is housing.

The shortage of housing, specifically affordable housing, is not an issue unique to Seattle. It's taking place all throughout the country. While politicians can, and will forever continue to offer solutions to this problem, I'm going to give you my wildly unpopular take. Brace yourself. Here it comes: And that is, housing is simply forever destined to be expensive in our region.

Before marching at me with pitchforks and torches, hear me out: while this is my opinion, it's shaped by some of the most trusted and influential sources when it comes to our regional housing market.

While attending a recent function with some of the region's best and brightest housing economists (Matthew Gardener and Mike Appleby), the fundamental dynamics of supply and demand, land use, and shifting population demographics were on major aspects of their presentation.

In as concise a summary as possible, the Greater Seattle area has more or less been entirely built out. That means any piece of developable land has already been developed to support a house. Note, that doesn't mean we've maximized the amount of houses we can build on every lot, but in other words, every lot that can feasibly contain a housing unit, already does. That's according to the last urban growth area plan that's now roughly 30 years old and hasn't been amended since. I won't get into all of that, but simply reshaping/rezoning some of those antiquated boundaries would open up more areas for future development. Back to the problem, there's really no developable land left.

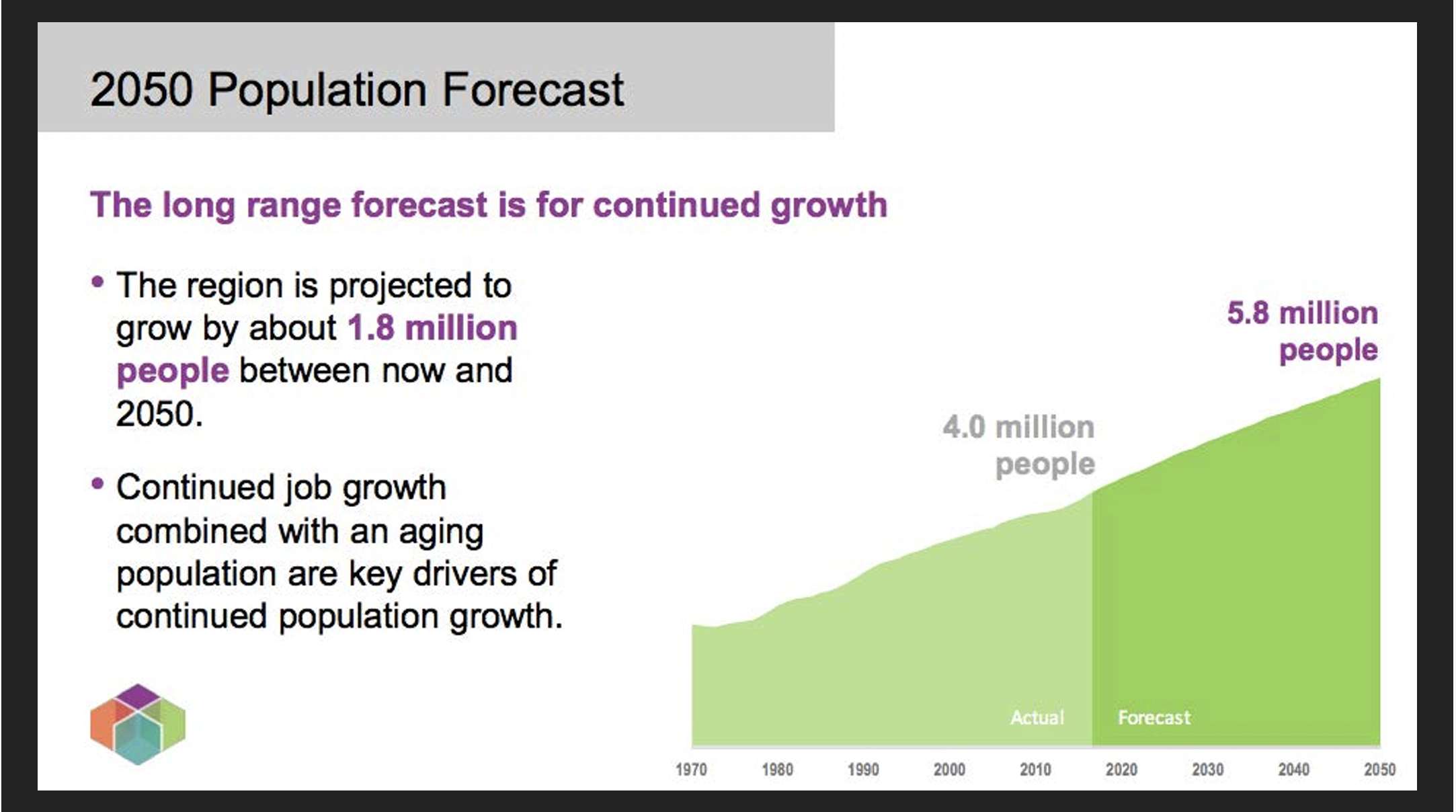

Additionally, regardless of what does or doesn't get changed in the UGA, we've got a growing problem:

Our region (King, Snohomish, and Pierce counties) are estimated to add over 1,500,000 people in the next 25 years taking the region's total population to just under 3,000,000. See below how cities within King County are forecasted to increase.

We've established there's no developable land left PLUS it's evident we need to embrace for continued population increase. Not a great combo when it comes to hoping for lower housing costs. But that's not all...

Circling back to politics; housing is (and should be) a very hot button issue when it comes to our local elections. Given the above, we know there's really nothing politicians, developers, anybody outside a divine intervention can do because we can't create more land. Being surrounded by water, forrests, hills, etc is one of the many reasons we love living where we do. But it also means we're topographically handcuffed from being able to create housing. Contrast this to areas like Texas, Las Vegas, the midwest, etc where land is so plentiful and building so easy (and far less expensive). More on that below:

Home construction/development is built upon four pillars:

1) Acquisition cost

2) Labor

3) Materials

4) Regulatory costs

We already established housing in general is expensive because of limited supply. Even those teardown homes that can be bought and replaced with multiple homes or townhomes are not cheap because the land is so valuable. Developers are paying a lot just to acquire the land, even when adding more homes than the one they're buying to tear down.

In case you've been living in a bubble over the past decade plus, just about everything costs more here compared to the rest of the country. This includes labor and materials. Our cost of living is high, therefore labor is very high. Materials aren't cheap either.

Perhaps the most forgotten variable in the cost of housing are the regulatory costs. It's estimated that roughly 25% of the total cost of home building is set aside for permitting and regulations. That's simply absurd.

If you want to look at the one area of housing a politician could actually make a realistic promise to reduce costs for the consumer, it's in the permitting process. Yet this is a huge revenue source for governments so can we really expect them to be okay with decreasing these fees? I'm not holding my breath. That being said, I will throw praise in the direction of Mayor Harrell and others who have recently recognized and made efforts to streamline the regulatory processes, and costs, that go into building ADU's, DADU's, and condominium-ized homes in Seattle.

I've been saying this for a LONG time, but in regard to housing I think the extreme NIMBY's are overly concerned at what additional housing in their communities will do to their home values, just as I believe extreme YIMBY's are far too hopeful thinking these added units will be "affordable". Housing is simply destined to forever be very expensive in our area. Don't be fooled by empty statements or promises from local politicians.

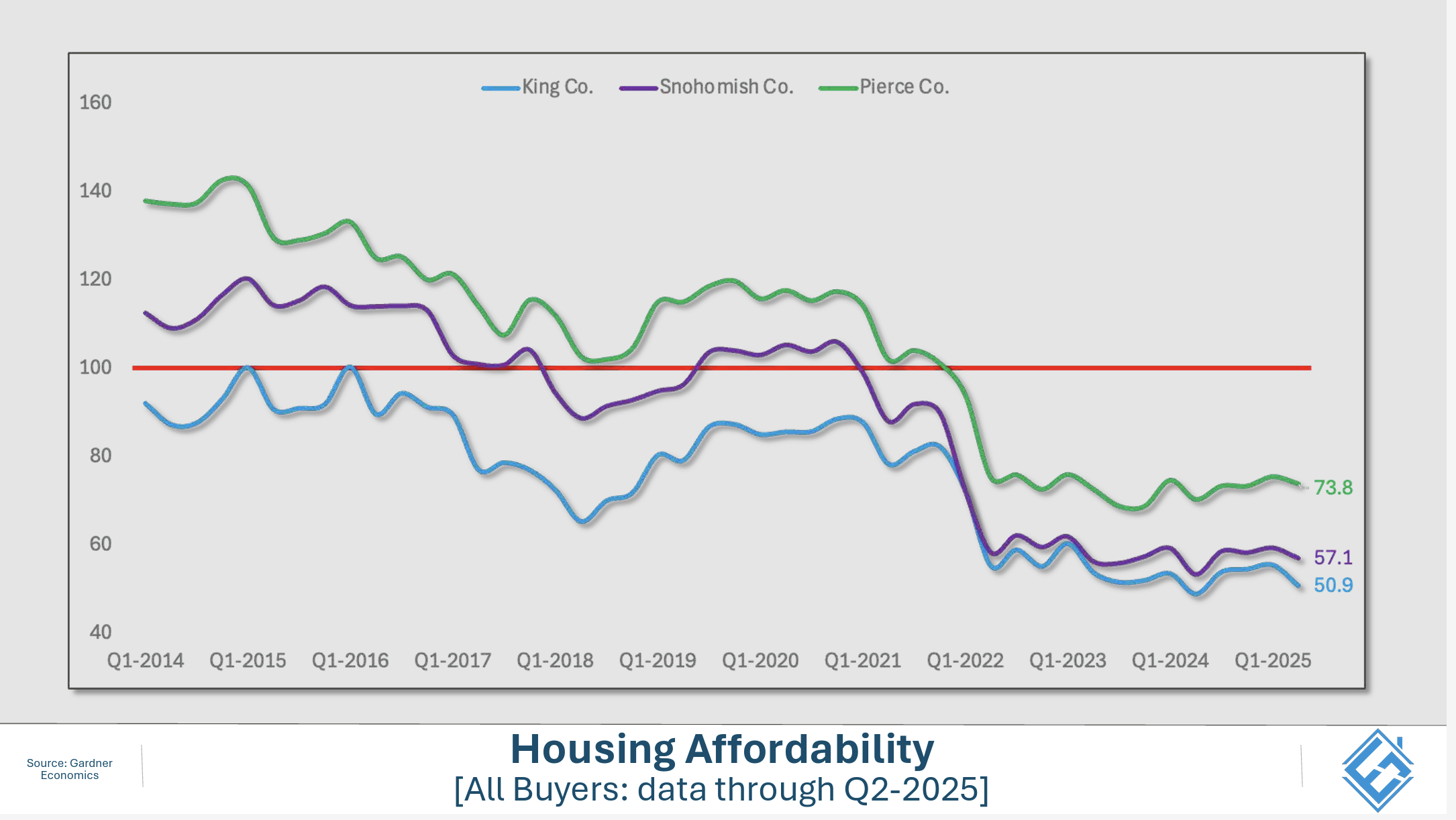

See overall affordability challenges below:

Onto the stats:

Seattle: September 2025 median sale price of $975,000. That is up 3.9% YoY, but down MoM from $1,000,000. Note, this was the first month since March that Seattle didn't notch a median sale price of $1m+. Inventory is up 12.1% YoY and the months of inventory increased to 3.08 months from 2.25, which is fairly significant.

Eastside: September 2025 median sale price of $1,575,000. That is up 3.1% YoY, and down MoM just $10,000. Inventory remains highly elevated at 60.3% more homes on the market YoY, yet the months of inventory increased only slightly to 2.79 months from 2.68 MoM.

King County: September 2025 median sale price of $957,000. That is up .7% YoY and down MoM from $990,000. Inventory is up 26.2% YoY and the months of inventory rose to 2.76 from 2.47 in August.

Have an amazing October! Onward!

Greater Seattle Housing Market Update — August 2025

Buyer activity hit multi-year lows, yet Seattle stayed a million-dollar city; the Eastside softened slightly and inventory is poised to tighten as we head into fall.

Welcome to the latest edition of the Greater Seattle Housing Market Update. As always, to skip the good stuff and go right to the latest figures for August, you can do so by clicking here. For more analysis, continue below!

This Seattle Times article was published on September 5th and it breaks down, very simplistically, the diverse real estate market that we're experiencing (bonus points if you noticed I'm quoted in this article). Perhaps more than ever since I've been a realtor, factors like location and property type are increasingly influential when factoring in time on market, and thus seller expectations. I've discussed this before in past market updates, but can't stress enough how important it is to paint finely as opposed to broadly when breaking down the local housing market.

I know the above isn't the prettiest, but bare with me. I want to include the connection between three variables: the median sale price, months of inventory, and median days to sell over the past 6+ years. What we see is a little different from what I would have expected.

Thinking back to our ECON 101 classes, we're reminded of the fundamental dynamics of supply and demand and I know nobody reading this is a stranger to the supply/demand relationship within housing. Especially over the last few years. But is the market cooling, or is it gaining strength? There are plenty of articles saying one thing or the other. So which is it?

In a vacuum, the higher the months of inventory goes, the more prices should remain neutral, or even drop. Instead, they're hovering around all-time highs. In fact, the city of Seattle has posted a $1,000,000 or higher median sale price for 6 consecutive months! There are only 3 months where Seattle has hit $1,000,000 or higher (ever!) and those months happened between April and June of 2022, which was the absolute peak of the market when buyers knew interest rates were on the rise and competition was fierce before rates got to a point that leveled demand. Given the financial hurdles over the past 3 years, I find Seattle's surge in the median sale price to be simply fascinating.

In past reports, I've proven that we have to dig a little deeper to find the truth with what's happening and showed that much of the increased inventory are townhomes. Land is king and homes that don't share walls and sit on lots big enough for yards, parking, etc, it's those homes that are becoming increasingly scarce, and thus disproportionately valuable relative to townhomes. To take it a step further, I wanted to also highlight a metric we haven't yet talked about. The homes that AREN'T selling.

Imagine that! Homes that actually don't sell during their time on the market. Believe it or not, this happens. My question; is this happening in greater numbers compared to previous years?

For context, I was only able to search listings that were canceled or expired within Seattle. There were too many results for King County and the NWMLS limits me whenever the data returns 5,000+ results.

Obviously we don't know just how 2025 will end up, but I'm a little surprised to see that there aren't more home listings being cancelled or expired in recent years compared to pre-pandemic years. So far, my theory that more homes were being listed and NOT selling, doesn't seem to be true. Darnit. Perhaps it's just they're taking longer to sell? That's a topic for another month.

One variable that could be a HUGE push for buyers is interest rates. At the time I'm creating this, mortgage interest rates are at their lowest levels in almost a year. The labor market is finally showing the cracks so many had expected were there and that's driving investors to the bond market, pushing mortgage rates lower. TLDR: economic turmoil, including poor job/labor figures, are generally positive for lower mortgage rates.

See the downward trend in the 30 year fixed above. Not satisfied? Still waiting for rates to drop below 6% before making a move? Well, we're already there...in a way. See below

Remember ARM loans? ARM = Adjustable Rate Mortgage. These are mortgages that are fixed for a certain period of time (7 years in this example) and then adjust every year after that. For years, ARM's have been completely irrelevant. Not just during the time the 30 year fixed rate was under 4%, but even more recently when there wasn't much difference between a 30 year rate and an ARM. However, that's recently started to change.

ARM rates are now below 6% and the spread between the rate on a 30 year vs an ARM is increasing making ARM's more attractive than they've been in years. If you're a buyer who's been on the fence waiting for rates to drop, you might want to talk with a mortgage lender on what ARM rates look like and how you might be able to accelerate that home purchase. And for those of you worried that the ARM loans today are the same risky mortgages that induced the Great Financial Crisis of 2007-8, don't be. The qualification requirements to be approved for ARM loans today is a complete 180 degree difference compared to the loans that sank the global economy. In fact, it's harder to qualify for an ARM mortgage than a 30 year mortgage!

Nevertheless, a .5%-.75% difference on a mortgage of $800,000 can be significant. A $260/month savings at a 6% rate compared to 6.5%. Additionally, $128/month difference in 5.75% vs 6%. Roughly a potential $375/month difference in 7/1 ARM interest rates vs 30 year fixed rates. I would definitely recommend looking at ARM's to buyers who KNOW they're not going to own the home for the entire fixed rate period, or if they plan on paying off that mortgage before the loan adjusts. Something to think about.

Onto the stats!

Seattle - The median sale price for a SFR in August 2025 was $1,000,000. That is up 7.5% YoY, and down just $10,000 MoM. Inventory is up 17.4% YoY and the months of inventory stat was flat MoM currently sitting at 2.25 months. Worth noting, the absorption rate was the LOWEST I have seen in my 6+ years measuring these stats.

Eastside - The median sale price in August was $1,537,500 (the lowest since November). That is down .8% YoY and down MoM from $1,580,000. Inventory is up 68.8% YoY and the months of inventory increased MoM to 2.68 months from 2.54.

King County - The median sale price in August was $990,000. That is up 3.67% YoY and down just $10,000 MoM. Inventory is still up 32.4% YoY and the months of inventory was stagnant MoM, currently sitting at 2.47 months.

Enjoy our last month of summer. Fall is upon us! Onward!

Seattle Condo Market Update– August 2025

Welcome to the latest edition of the Seattle condo market update. As always, you can skip the good stuff and go right to the stats by clicking here. For more detailed, and hopefully entertaining info, continue reading below!

I've got to admit, each month I struggle trying to find new material for this writeup. The Seattle condo market has been stuck in the mud for so long that I feel like Bill Murray from Groundhog's Day where each month I see the same data and forcibly try to create new stories out of nothing. For those of you who have soldiered on reading these, I genuinely appreciate you and hopefully one day these reports will kick it up a few notches from an entertainment and value perspective.

(This is me assessing the health of the condo market month after month)

If you have access to the Seattle Times, you can read an article I contributed to here discussing one of the problems with the current market. The problem I refer to in the article is that the monthly cost of a mortgage compared to renting a similar property has really widened.

For example, look at this Belltown condo that's currently for sale. If a buyer were to purchase this home by putting 20% down, their total mortgage payment (at 6.25%) would be $2,900. Yet a similar 1 bedroom unit in this building just rented in early August for $2,225/month. That's a $675/month difference in monthly payment! Furthermore, this condo currently for sale was purchased back in 2019 for $433,000 (currently listed for $389k). Tell me what is attractive to consumers looking at paying a 30% monthly premium for an asset that's been, let's face it, borderline toxic over the past 7-8 years.

Owning has almost always been more expensive on a monthly housing payment comparison, but the long term benefit homeowners could safely bet on was appreciation. Yet appreciation, for a number of years, has not been the consistent savior it's historically been. To be fair, there are still tax and other advantages that help highlight the pros of homeownership, but they often don't outweigh the superficial savings consumers see when there's a staggering distance in monthly living costs like we're currently seeing between a mortgage and rent.

However, that margin between the cost of renting vs buying might be changing, and might not favor renters as much as it currently does. See this Seattle Times article highlighting the lack of apartment construction and some of the more powerful highlights below:

"Across King County, local governments permitted fewer multifamily units in 2024 than they did in any year of the prior decade. The slowdown appears to be here to stay for now. In Seattle, apartment permitting was down 66% in the first six months of this year, compared with the same period a year ago."

"For renters, this decline means they will likely find fewer available apartments and higher rent increases in the years to come, as the market absorbs a glut of apartments permitted during ultralow interest rate pandemic years."

"This year, Seattle is now on track to experience one of its slowest years for apartment permitting since at least 2018."

There's no saying that the dynamics will make a 180 degree turn around and revert to what we became accustomed to during the 2010's, but it does appear that we might be starting to exit the most renter friendly period we've seen in a very long time. I know in past reports I've identified variables that could provide relief to the Seattle condo market (RTO mandates, FHA/VA condo approvals, and now a slowdown in apartment building), but nothing has single handedly, or collectively, made any dent in the hemorrhaging condo market. In fact, the absorption rate this month was the lowest since September of last year, which was an all-time low in the time I've been measuring it.

Onto the stats!

The median sale price for a Seattle condo in August 2025 was $595,000. That is up 7.2% YoY and up from $550,000 MoM. Inventory remains elevated at 23.6% more homes on the market than the same month last year. The months of inventory statistic didn't change MoM as there's still 5.1 months of inventory.

Enjoy the last week of summer. Bring on fall! Onward!

Who can save the condo market? The Seattle Condo Market Update, August 2025

Welcome to the latest edition of the Seattle Housing Market Update. As always, to skip the fun stuff and go right to the latest monthly stats, click here. To learn more about what's going on in our local condo market, continue below!

As the title suggests, everybody in the real estate industry from local realtors to head economists at Fortune 500 companies are asking the same question: Where are the buyers? This Seattle Times article breaks down the declining percentage of married homeowners between the ages of 25-34 since the 1960's. To be fair, there are many variables that have contributed to declining levels in both homeownership and marriage between this age group. Still, for home sellers, particularly homeowners of riskier assets like condos, a buyer population delaying home purchasing is not the most encouraging news.

Going a step further, I'm curious if there's a potential demographic of buyers who might be able to save the condo market?

So who could potentially represent the savior(s) for the condo market? My theory; perhaps it's time condo associations start appealing to buyers seeking government financing, specifically VA and FHA mortgages.

Let's take a step back. There are primarily 3 types of mortgages buyers can obtain (4 if counting jumbo loans, but we'll exclude them for the purposes of this email). By far, the most popular is the standard conventional mortgage. These are the loans that are underwritten and guaranteed by Fannie Mae and Freddie Mac.

FHA financing is a government sponsored loan that often gets the moniker of being a first time home buyer loan. These loans don't only apply to first time home buyers, however the looser restrictions around down payment (3.5% minimum), credit score, and debt-to-income ratios (allowing over 50%) often make it more ideal for some first time buyers.

VA (Veterans Affairs) financing is a very special lending option open to active and past servicemen and women. This is also government sponsored and does not require any down payment in addition to requiring the seller to pay for certain fees normally absorbed by the buyer/vet.

Back to my point...

Year to date, I've had a few challenging condo listings that were ultimately saved by buyers seeking VA or FHA financing. One instance was a condo in Belltown that was on the market over 400 days. We actually sold the unit twice, both times to a VA buyer, but the first buyer backed out 10 days before closing and lost their earnest money. I maintain that the only reason we sold this condo was because we were the only condo project in Belltown that was VA approved. We needed a miracle and that prayer was answered thanks to a VA buyer.

In another listing, this particular building was not FHA or VA approved, however after almost 2 months on the market we received an offer from a buyer seeking FHA financing. Note, just because the building is not FHA approved doesn't necessarily mean that a buyer can't purchase a unit securing FHA financing. This is called a spot approval. Long story short, but after the first lender failed to secure the approval in the 11th hour, another lender jumped in and saved the day. Because this buyer could only be approved for FHA financing, and due to no other condos in this area (Ballard) being approved for FHA financing, we really had no competition for our buyer.

I know this is all anecdotal, but maybe my experiences might be a microcosm for the greater condo market?

I created the graph above charting the number of condos bought/sold in Seattle dating back to 2010 and the total number of FHA and VA buyers. Note the massive drop off after 2010 and ask yourself, why were buyers for Seattle condos seeking government loans in such great numbers 10+ years ago?

The answer is simple. The housing market was still bottoming out from the Great Financial Crisis and condo associations knew that in order to maximize their chances of selling units most quickly and for as high a sale price as possible, they needed to appeal to every buyer possible. That included jumping through every administrative and financial hoop necessary to become FHA and VA approved. However, as the years went on, and the market rebounded and strengthened into the behemoth we know it to be now, associations became a little...lazy? Picky? Elitist? Probably a little of each.

To be fair, the percentage of buyers seeking FHA or VA financing is pretty slim these days.

Loan Type 2019 2023 2024

Conventional 89.7% 90.7% 90.6%

FHA 5.5% 5.9% 5.5%

VA 4.8% 3.4% 3.9%

We can see that last year, within King County, less than 10% of home buyers utilized FHA or VA financing. If there were a way to break this down into condos, I'm sure the percentage would be even smaller.

If I were a condo owner, regardless if I had any intention of selling anytime soon, I'd strongly encourage the governing body of the association to look into becoming FHA and/or VA approved. Not only does it allow your realtor the ability to market the unit to a wider range of buyers, but meeting FHA and VA approval standards ensures the financial strength of the association will not be an issue for any financing type, whether that be conventional, or either of these government backed programs.

Onto the stats: In July of 2025, the median sale price of a Seattle condo was $550,000. That is down 1.6% YoY and down from $589,000 MoM. Inventory is up 29.3% YoY and the months of inventory statistic jumped to 5.10 months from 4.63 the month prior. Note, the downtown and Belltown areas are currently experiencing 10.3 months of inventory!

Enjoy the final stretch of summer! Onward!

A shrinking window of opportunity. The Greater Seattle Housing Market Update, August 2025

And welcome to the latest edition of the Greater Seattle Housing Market Update. As always, to skp the good stuff and go right to the stats, you can watch a video by clicking here. For the rest of you, continue below!

We're smack dab in the middle of what I call the "opportunity season" for buyers. What I mean by that is this; we're no longer in the scarcely listed months of the year (Q1 and early Q2) that are historically a seller's best friend where they capitalize on strong buyer demand and minimal competition from other competing homes for sale. Inventory levels are increasing month by month (and will likely continue to do so for another month or two), but we might be beginning to see this window of opportunity starting to close on buyer's.

Happy to, Seth! See below!

I apologize, the chart above is a little messy, but the point I want to convey is this; while overall inventory for SFR homes in King County are at their HIGHEST levels since June of 2019, new listings have now declined month over month for the third straight month. The new listing data is a leading indicator to overall inventory so what I expect to see over the next 1-2 months is overall inventory increasing before we see significant drops in Q4 (November, specifically).

Buyer's if there is a window of time where you can maximize your chances to get into a home 1) without competing against other buyers, 2) without waiving contingencies, and/or 3) negotiating the home at or under the asking price, the data suggests THAT TIME IS NOW! Note, this is not me encouraging you in attempting to time the market. If we've talked before then you know I never preach timing the market. Buy when the time is right for you and your lifestyle. Still, the data is hard to ignore the opportunity it presents every year at this time.

Furthermore, and just for fun, I'll assume the role of playing devil's advocate as to why this window of opportunity might be closing quicker than we would expect.

See the graph (blue line) above charting the 30 year mortgage rate YTD. At the time I'm creating this article, interest rates are not only at their lowest level of the year, but at their lowest levels since October of last year. This has primarily been driven by favorable news on the tariff front as those have become more settled, and so far, haven't created the long term turbulence many had feared. Again, we're not 100% in the clear here, but so far the markets are pretty comfortable with the outlook on how these will continue to settle. Remember, markets LOVE stability.

I see your interest rates and raise you the general YTD stock performances in both the S&P 500 and Nasdaq, as well as some of our region's biggest employers. Starting with the below S&P 500 and Nasdaq.

The stock market has been on a tear this year. After the crash induced Liberation Day announcements, the overall market has 100% rebounded and continued to push all time highs (at the time of this typing). We're seeing this first hand with some of our regional behemoths (below).

With many homebuyers working for these local economic powerhouses, especially those in the tech fields, it's not uncommon to see down payment sizes tied to the stock price of their respective companies. A stronger performing stock, the more a buyer can draw from that and use toward a down payment, thus increasing their buying power.

Don't get me wrong, layoffs have been taking place left and right YTD (especially in tech), so while the stock portfolios of those still employed continue to bloom, the overall uneasiness may keep those potential buyers on the sidelines until they feel greater stability in their professional future.

Bottom line; 60-90 days from now we can expect to see significant drops in available homes for sale. If mortgage rates continue to stabilize, or even decline while the stock market continues to chart new highs, we could be primed for a very seller friendly and competitive Q1/2 of 2026. This can result in bidding wars, escalated sale prices, waiving of contingencies, etc. Not anything we don't already see most Q1/2 of every year, but perhaps it can be argued we could be on the path of things being more escalated than they have in recent years. Again, just playing devil's advocate here, but it's not the craziest outcome to consider.

Onto the stats:

Seattle: July 2025's median SFR sale price was $1,010,000. That is up 3.9% YoY and down MoM from $1,080,000. Note, this is the 5th straight month Seattle has registered a median sale price of at least $1,000,000. Never before has this been accomplished. Inventory is up 19% YoY and the months of inventory was flat MoM.

Eastside: July 2025 median SFR sale price of $1,580,000. That is down 2.5% YoY and down MoM from $1,610,000. This is the first time all year the median sale price has dipped below $1.6m. Inventory is still up big at 90% more homes on the market YoY, however the months of inventory decreased MoM from 2.64 to 2.54.

King County: July 2025 median SFR sale price of $1,000,000. That is flat YoY, but down MoM from $1,039,000. Inventory is up 43.3% YoY and the months of inventory was flat MoM and remains at 2.4 months.

Enjoy and onward!

Who's really the boogeyman? The Greater Seattle Housing Market Update, July 2025

Welcome to the latest and greatest Greater Seattle Housing Market Update. I hope your summer is going well and you're getting plenty of vitamin D. As always, to jump right into the stats you can do so by clicking here. For more/better information (and hopefully some entertainment), keep reading below!

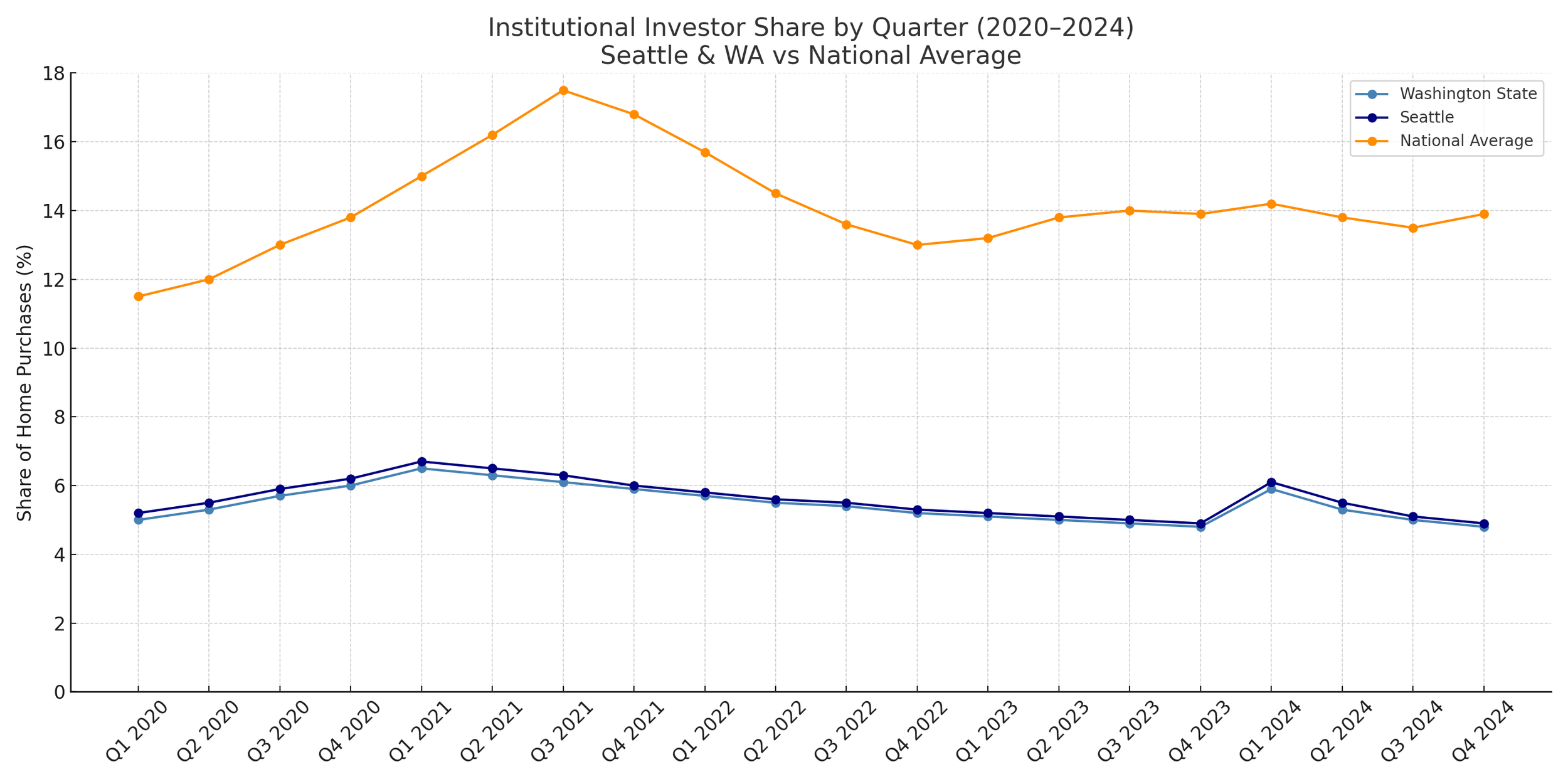

Given the subject of this article, I understand this would have been more appropriate to post in October, but I want to talk about something that's been grinding my gears for years. Or maybe I'm just experiencing writer's block? Either way, over the years I've consistently heard a lot of misinformation when it comes to our local housing market, but probably the most misunderstood belief I see, hear, and read all over the place is that investors are to blame for inflationary costs of real estate.

"If it weren't for investors gobbling up houses, first time home buyers would be able to buy." Or "we need to tax all the homes just sitting vacant or not allow homes to be used for investments". Or "investors are pricing out first time homebuyers." And dozens of different versions of these arguments.

I'll preface my response that, like everything, the validity of this belief/argument depends on one's location. I 100% believe that in some areas of the country this problem can be very real. However, as the data will show, there isn't any merit for this argument in the Greater Seattle area, let alone in Washington State.

Institutional investors are defined as investors who purchase 10+ homes within a calendar year. This includes companies like Black Rock, probably the most infamous real estate investment brand when it comes to purchasing rental properties, and could also include very active flipping companies that operate within their own backyard. The graph above charts the purchase activity of institutional investors through the first quarter of 2025.

Above is for all of 2024.

And the above shows the comparison going back to 2020.

What is glaringly obvious is that institutional investors in the Greater Seattle area and Washington state are buying real estate at a fraction of the level compared to the national average. In fact, the median percentage of homes bought by institutional investors at this time was only 5.35% and 5.5% in Washington State and Seattle, respectively. Nationally, that median figure was 13.85%.

According to this article from the University of Washington, they estimate ~78,000 homes sold across Washington state in 2024. If we take the average rate of consumption by institutional investors for 2024 (5.4%), that's 4,200+ homes sold, which isn't totally insignificant, but it's hardly enough to single handedly point the blame at one demographic of the home buying population.

You want the dirty truth? Can you handle it?

The reality is that, if you're looking for a demographic of who to blame for rising housing prices...look in the mirror.

The truth can hurt, but it can also be revelatory. The buyer's in the Greater Seattle area you're competing against are likely to be very similar to you. They're not faceless investors competing to buy your home to simply add to their massive rental portfolio. Especially with the increase of mortgage rates over the past 3 years, it's even less likely they're investors at all whether that be institutional or mom and pop investors. Instead, they're just like you. A FTHB looking to get their foot into the door of homeownership. They're move-up buyers looking to expand their housing footprint to satisfy their expanding lifestyle. They're relocating into the city to be closer to work, they're moving to the suburbs for more space, they're relocating to another state to be closer to family, etc. You are the competition!

The data shows us that, rather than a single boogeyman existing, the market is made up of tens of thousands of different boogeymen and women, in more or less the same mold of each other. Don't get me wrong, investors contribute to inflated home prices, but not by any significant margin. It's our peers who are driving up the cost of homes, which of course has been exacerbated by the shortage of homes over the past 10+ years.

On that note...did you know that last month recorded the highest level of inventory in King and Snohomish counties (combined) since June 2019? And the months of inventory was the highest since January of 2019.

Yet, despite that, we set all time records for the median sale price in Seattle and King County.

I know. It defies intuition. See the stats below:

Seattle: June 2025 median sale price of $1,079,950. That is up 12.9% YoY and up MoM from $1,010,650. Inventory is up 35% YoY and the months of inventory dropped to 2.2 months from 2.5 months in May.

Eastside: June 2025 median sale price of $1,610,000. That is down 1.5% YoY and down from $1,633,500 MoM. Inventory is up 91.7% YoY and the months of inventory dropped slightly to 2.6 months from 2.7 months in May.

King County: June 2025 median sale price of $1,033,950. That is up 7.2% YoY and up MoM from $989,000. Inventory is up 49.7% YoY and the months of inventory dropped to 2.37 months from 2.45 months in May.

Have an amazing July! Onward!

Buyer's to the rescue? The Seattle Condo Market Update, July 2025

Welcome to the latest and greatest edition of the Seattle condo market update. As always, to skip right to the data, you can do so by clicking here. For more education, and maybe some entertainment, continue below!

Well, let's start with the bad news.

June of 2025 was not a great month for Seattle condo sales. In fact, the absorption rate registered the lowest level since September of last year and one of the lowest levels of all time. Remember, the absorption rate is essentially the rate at which buyers are absorbing the available inventory.

To be fair, Q3 is the time of year when absorption historically tanks (yes, I know June is still Q2) so to see poor levels this early isn't a great leading indicator for what the next few months might look like. That being said, there could be a savior for the market lurking in the shadows.

Above is the graph charting mortgage purchase applications since the beginning of last year. For a number of consecutive weeks/months, the growth in mortgage purchase applications has reflected YoY double digit growth. And earlier this month topped the highest week for activity since late January 2024. To be fair, 2024 was putrid for purchase applications so while the gains are significant, comparing today's numbers to one of the most dormant times in history isn't exactly something worthy of a parade. Still, it's hope! Imagine what this would look like once rates start consistently trending downward (though it's been 3 years since our industry has been saying that).

Of course, as I've made painfully clear in numerous past reports, location, the number of bedrooms, and the type of condo make huge differences in seeing what's being absorbed by buyers. Avoiding the news headlines and diving deeper into the sub-markets will help expose the real stories with what's going on in our local market.

Onto the stats:

In June 2025 the median sale price for a Seattle condo was $589,000. That is up 7.1% YoY and up from $573,250 the month before. Inventory is up 25.6% YoY, but the months of inventory dropped to 4.6 months from 5 months in June.

Enjoy your summer! Onward

Can we exit this ride? The Seattle condo market update, April 2025

Welcome to the latest edition of the Greater Seattle Housing Market Update. As always, to skip the good stuff and go straight to me sputtering out the facts, you can watch by clicking here.

What a time to be alive! Holy cow, unless you've been living in a cave year to date (in which case, I'm jealous), you've been relentlessly distracted with all that's going on in the finance world. Tariffs, interest rates, crashing/surging stock markets, etc. Every day seems to be more volatile than the last, making this the most turbulent financial roller coaster I can remember.

(BTW, I hate roller coasters. Unforutunately, I have zero tolerance for motion sickness stuff so these are torture for me). Perhaps equally as nauseating as a real roller coaster has been the economic roller coaster we've experienced since Trump (re)entered office. Take a look at some of the charts below.