Buy the Dip? The GSHMR for January, 2026

Welcome to the latest edition of the Greater Seattle Housing Market Review. As always, to skip right to the stats, click here. For more information, continue reading below!

As the title suggests, January produced some pretty sluggish numbers for a number of different metrics. And as I've reported on in the past, this is the "dip" before the market begins to take off. See my report here I wrote just a few months ago on this topic.

However, while January every year is a step back before taking multiple steps forward, 2026 started off with more of a setback than what we're used to seeing.

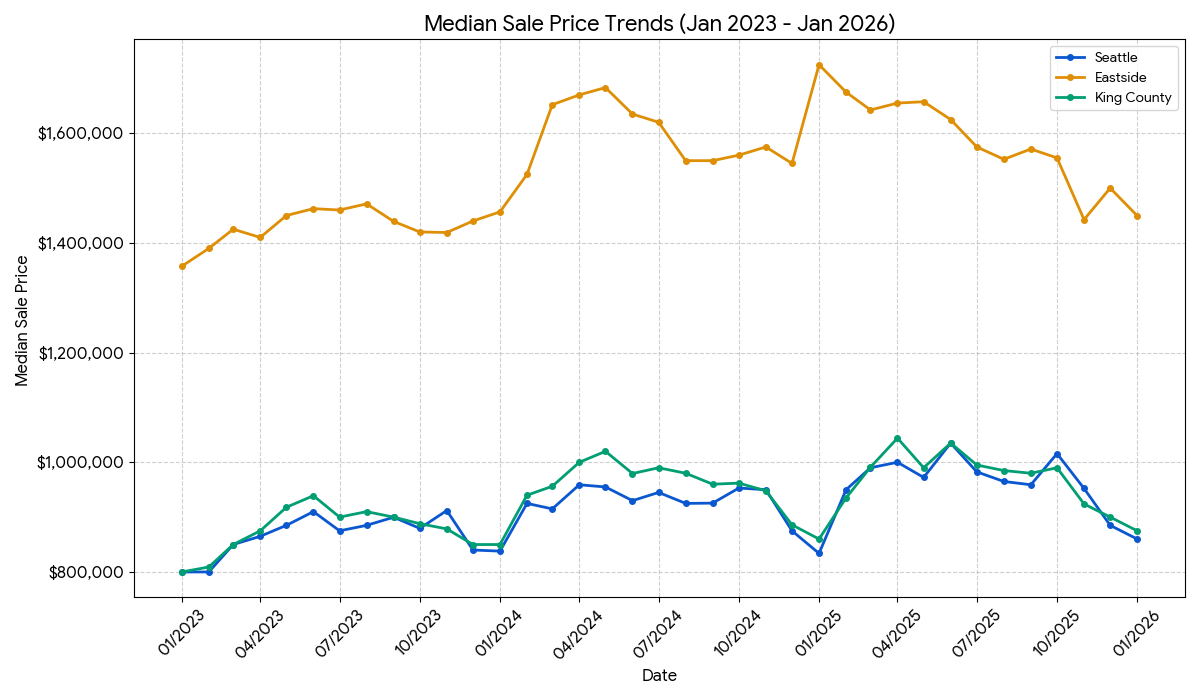

Starting with the median sale prices, Seattle saw the lowest median sale price ($850,000) since December of 2023. The Eastside ($1,435,000) wasn't this low since November of 2023 and King County as a whole ($850,000) wasn't this low since January of 2024.

While the absorption rate for Seattle was the highest it has been since July, it was still the lowest January reading since I've been collecting this data going back to 2019. Additionally, it wasn't even close with buyers absorbing inventory at roughly 25% less than January of 2025.

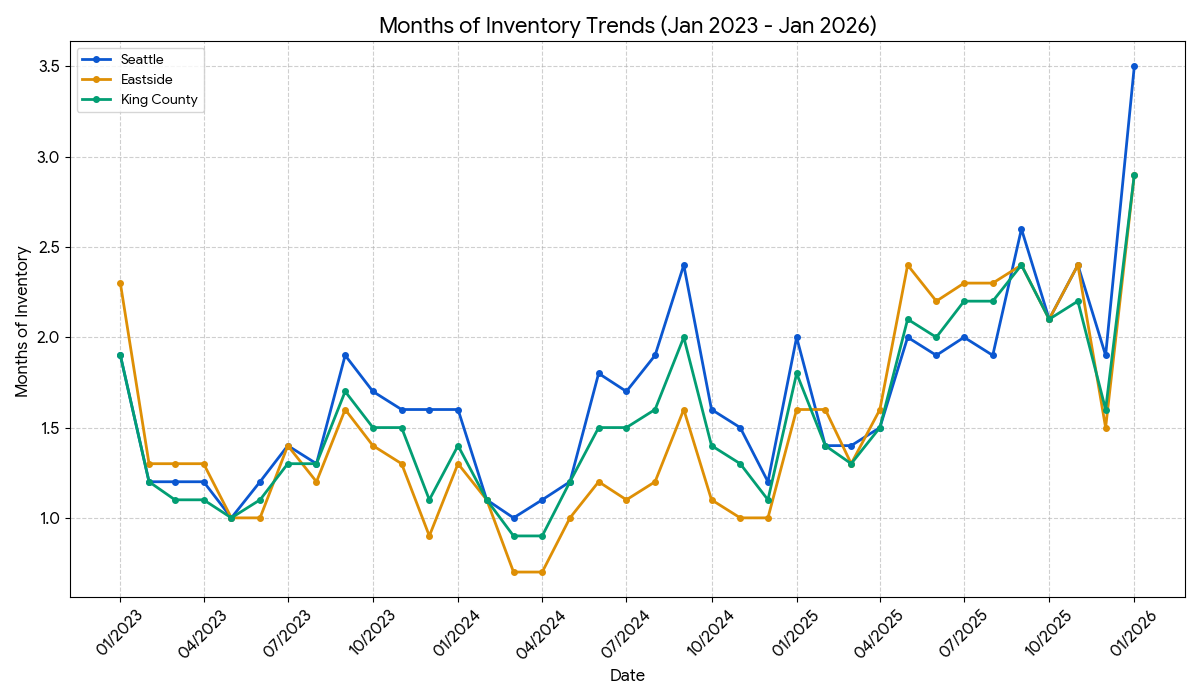

What surprised me the most was the months of inventory. Typically, January is one of the lowest points in the year for this metric as inventory is always slow to pick back up after a dormant end to Q4. Surprisingly, this number increased for each area month over month and was up quite significantly year over year.

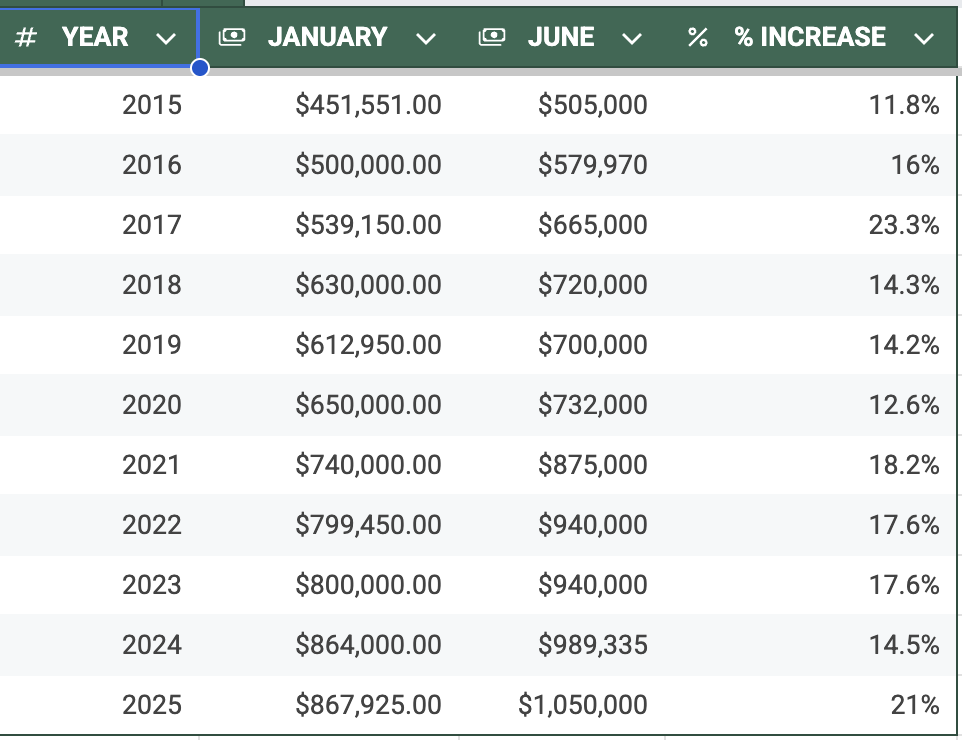

The graph below I used in a report about 3 months ago to show how, every year, January represents the low point for property values before they take off in the next 4-5 months. (This was for King County)

Given what we've seen the last 10 years (and beyond, I chose not to include any more history for the purposes of keeping this as succinct as possible) we're just getting out of that "dip" before values historically begin to take off.

Does this mean buyers have missed the boat? No, not at all. Some of the reason as to why values in January are depressed relative to the rest of the year is because much of what's selling in January was listed in October, September, August, etc and thus sat on the market for a few months, had one or more price reductions, and overall sold under the asking price.

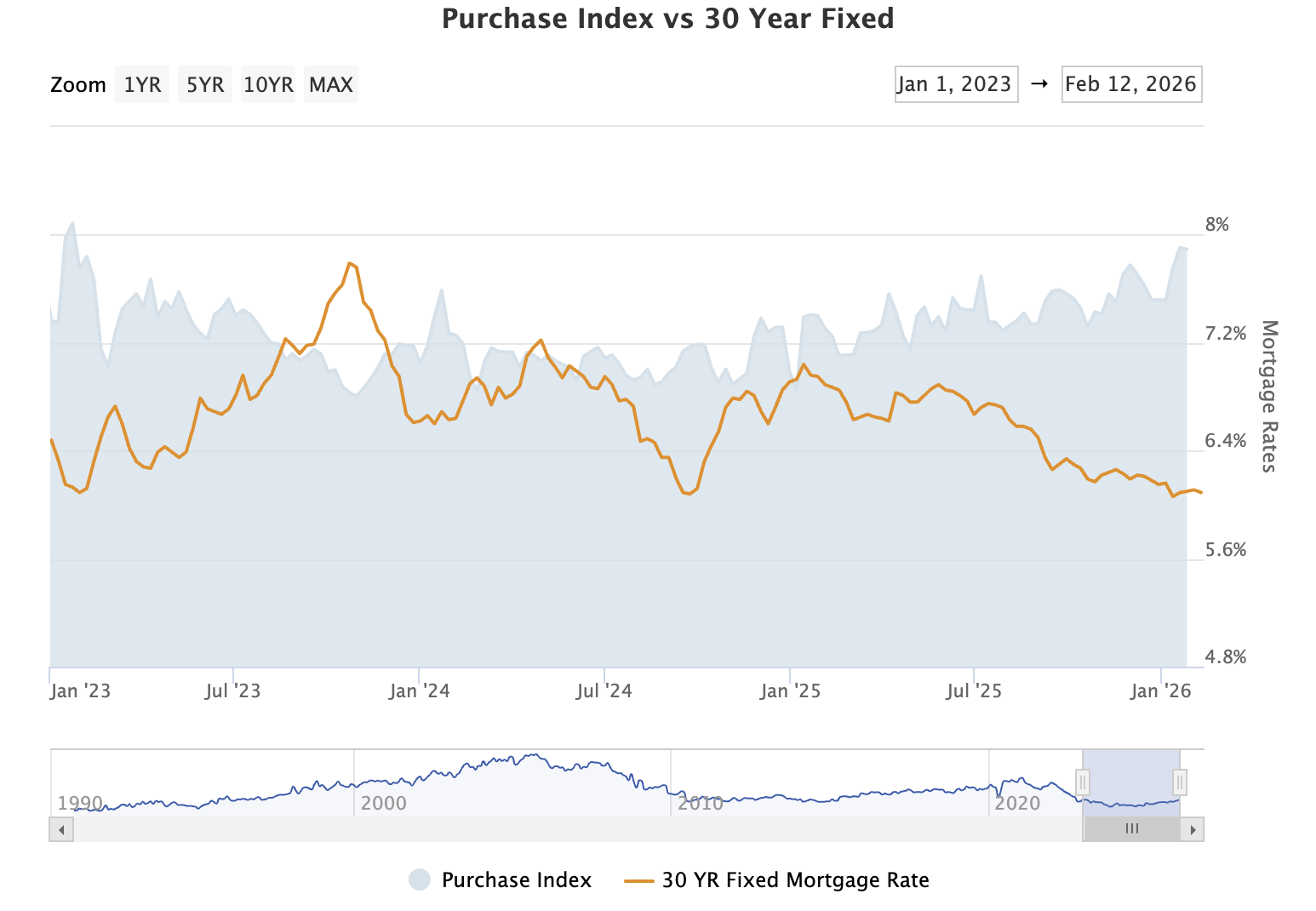

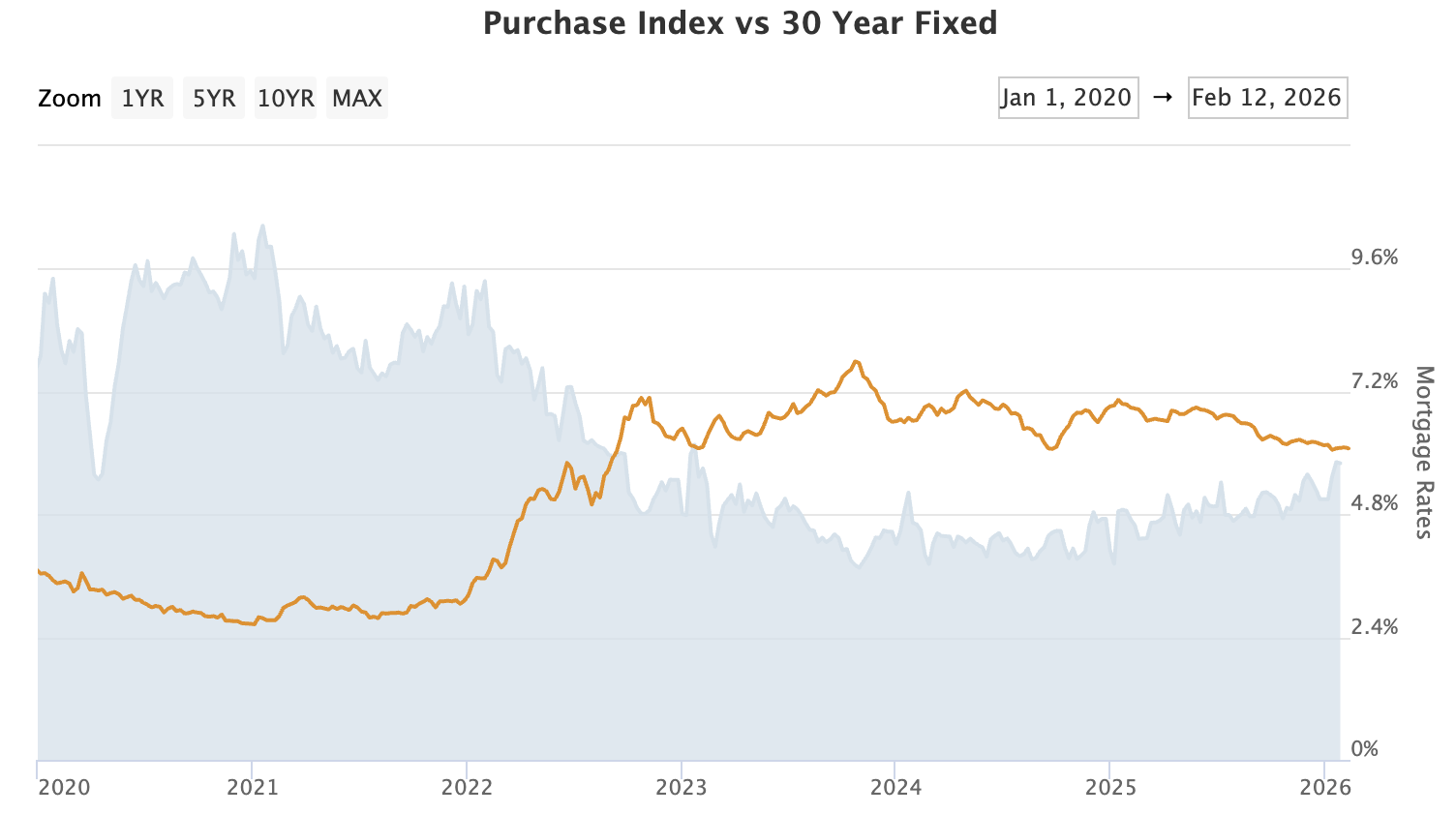

What I'm seeing anecdotally right now suggests the opposite as multiple offers are back. I've even seen a few cases where properties that had been sitting on the market dormant for 70+ days suddenly received multiple offers. Perhaps some of this can be attributed to the graph below:

Above, in the dark shaded data, is the purchase application index that tracks national purchase applications for mortgage applicants. This January we reached levels we have not seen since January of 2023.

Before we throw any parades, let's keep in mind that these figures are still roughly half of what application rates looked like during the post Covid bubble (see above). Still, there's hope that this might signify we've passed the bottom and are on our way out of the housing recession we've been in for almost 4 years. More buyers applying for mortgages is a pretty obvious precursor to more homes being purchased, right? Time will tell.

Onto the stats: A little anticlimactic since I already discussed these, but nevertheless, here we go!

Seattle - January 2026 median sale price of $850,000. that is down .87% YoY and down from $914,000 MoM. Inventory was up 29.9% YoY and the months of inventory statistic increased dramatically MoM to 3.39 from 2 months.

Eastside - Median sale price of $1,435,000. That is down 16% YoY and down MoM from $1,500,000. Inventory remains elevated at 49.34% more homes on the market YoY and the months of inventory rose to 3.17 from 1.58 in December.

King County - Median sale price of $850,000. That is down .58% YoY and down MoM from $900,000. Inventory is up YoY b 31.13% and the months of inventory rose to 2.92 from 1.68.

I hope you all properly celebrated the Seahawks Super Bowl victory! Below is a picture a colleague of mine found. Sadly, despite this person having a striking resemblance to me, I can confirm this is not me. But I can assure you we shared the same spirit that day. Go Hawks!

Onward!