Seattle & Eastside Real Estate Market Update — September 2025

Welcome to October!

And welcome to the latest edition of The Greater Seattle Housing Market Update. As always, to skip the good stuff and go straight to the stats video, you can do so by clicking here. But for deeper reporting, continue reading below.

It's election season! At least it is in Seattle, where our mayoral election is set to take place next month. Incumbent Mayor Bruce Harrell is hoping to best challenger Katie Wilson and one of, if not the hottest issue on the minds of voters, is housing.

The shortage of housing, specifically affordable housing, is not an issue unique to Seattle. It's taking place all throughout the country. While politicians can, and will forever continue to offer solutions to this problem, I'm going to give you my wildly unpopular take. Brace yourself. Here it comes: And that is, housing is simply forever destined to be expensive in our region.

Before marching at me with pitchforks and torches, hear me out: while this is my opinion, it's shaped by some of the most trusted and influential sources when it comes to our regional housing market.

While attending a recent function with some of the region's best and brightest housing economists (Matthew Gardener and Mike Appleby), the fundamental dynamics of supply and demand, land use, and shifting population demographics were on major aspects of their presentation.

In as concise a summary as possible, the Greater Seattle area has more or less been entirely built out. That means any piece of developable land has already been developed to support a house. Note, that doesn't mean we've maximized the amount of houses we can build on every lot, but in other words, every lot that can feasibly contain a housing unit, already does. That's according to the last urban growth area plan that's now roughly 30 years old and hasn't been amended since. I won't get into all of that, but simply reshaping/rezoning some of those antiquated boundaries would open up more areas for future development. Back to the problem, there's really no developable land left.

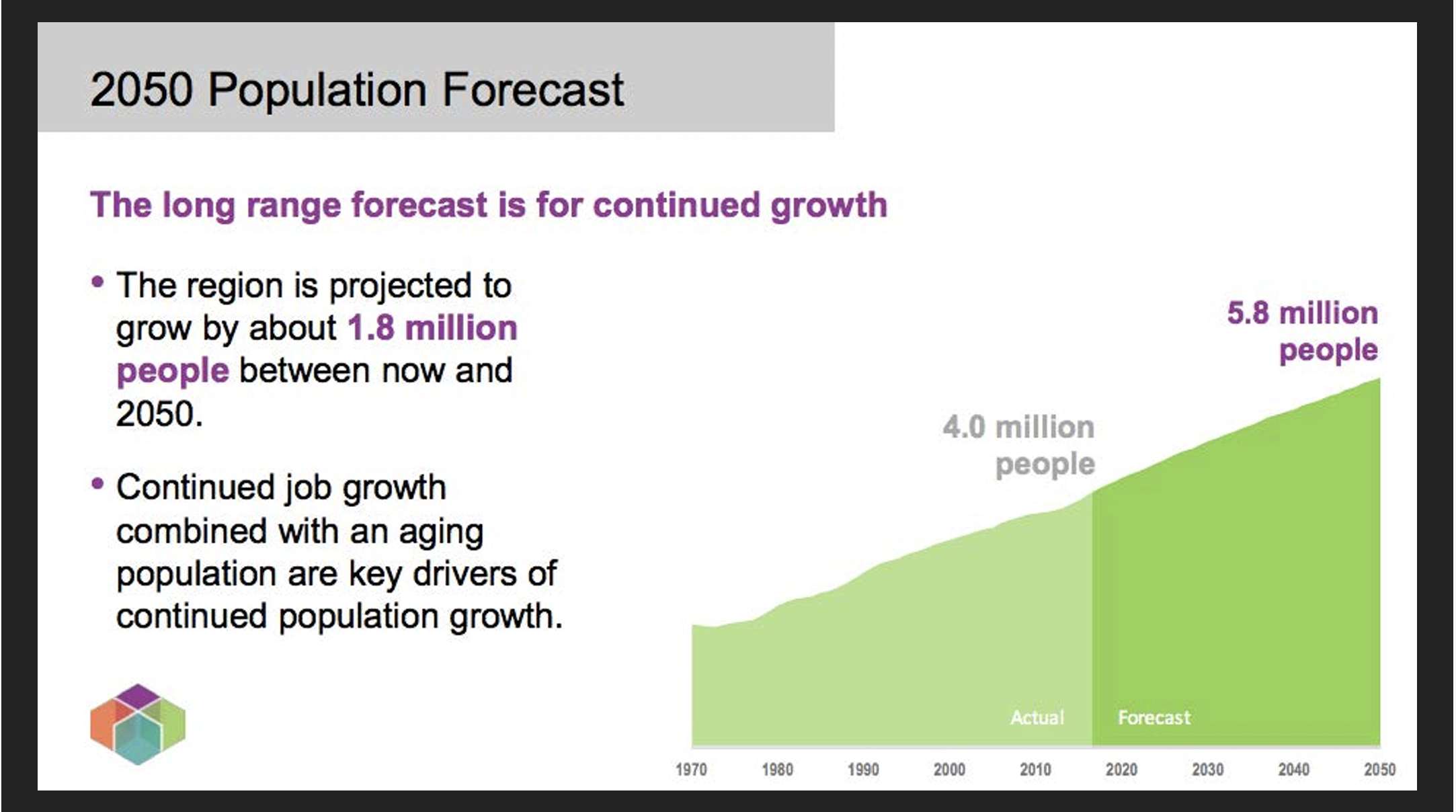

Additionally, regardless of what does or doesn't get changed in the UGA, we've got a growing problem:

Our region (King, Snohomish, and Pierce counties) are estimated to add over 1,500,000 people in the next 25 years taking the region's total population to just under 3,000,000. See below how cities within King County are forecasted to increase.

We've established there's no developable land left PLUS it's evident we need to embrace for continued population increase. Not a great combo when it comes to hoping for lower housing costs. But that's not all...

Circling back to politics; housing is (and should be) a very hot button issue when it comes to our local elections. Given the above, we know there's really nothing politicians, developers, anybody outside a divine intervention can do because we can't create more land. Being surrounded by water, forrests, hills, etc is one of the many reasons we love living where we do. But it also means we're topographically handcuffed from being able to create housing. Contrast this to areas like Texas, Las Vegas, the midwest, etc where land is so plentiful and building so easy (and far less expensive). More on that below:

Home construction/development is built upon four pillars:

1) Acquisition cost

2) Labor

3) Materials

4) Regulatory costs

We already established housing in general is expensive because of limited supply. Even those teardown homes that can be bought and replaced with multiple homes or townhomes are not cheap because the land is so valuable. Developers are paying a lot just to acquire the land, even when adding more homes than the one they're buying to tear down.

In case you've been living in a bubble over the past decade plus, just about everything costs more here compared to the rest of the country. This includes labor and materials. Our cost of living is high, therefore labor is very high. Materials aren't cheap either.

Perhaps the most forgotten variable in the cost of housing are the regulatory costs. It's estimated that roughly 25% of the total cost of home building is set aside for permitting and regulations. That's simply absurd.

If you want to look at the one area of housing a politician could actually make a realistic promise to reduce costs for the consumer, it's in the permitting process. Yet this is a huge revenue source for governments so can we really expect them to be okay with decreasing these fees? I'm not holding my breath. That being said, I will throw praise in the direction of Mayor Harrell and others who have recently recognized and made efforts to streamline the regulatory processes, and costs, that go into building ADU's, DADU's, and condominium-ized homes in Seattle.

I've been saying this for a LONG time, but in regard to housing I think the extreme NIMBY's are overly concerned at what additional housing in their communities will do to their home values, just as I believe extreme YIMBY's are far too hopeful thinking these added units will be "affordable". Housing is simply destined to forever be very expensive in our area. Don't be fooled by empty statements or promises from local politicians.

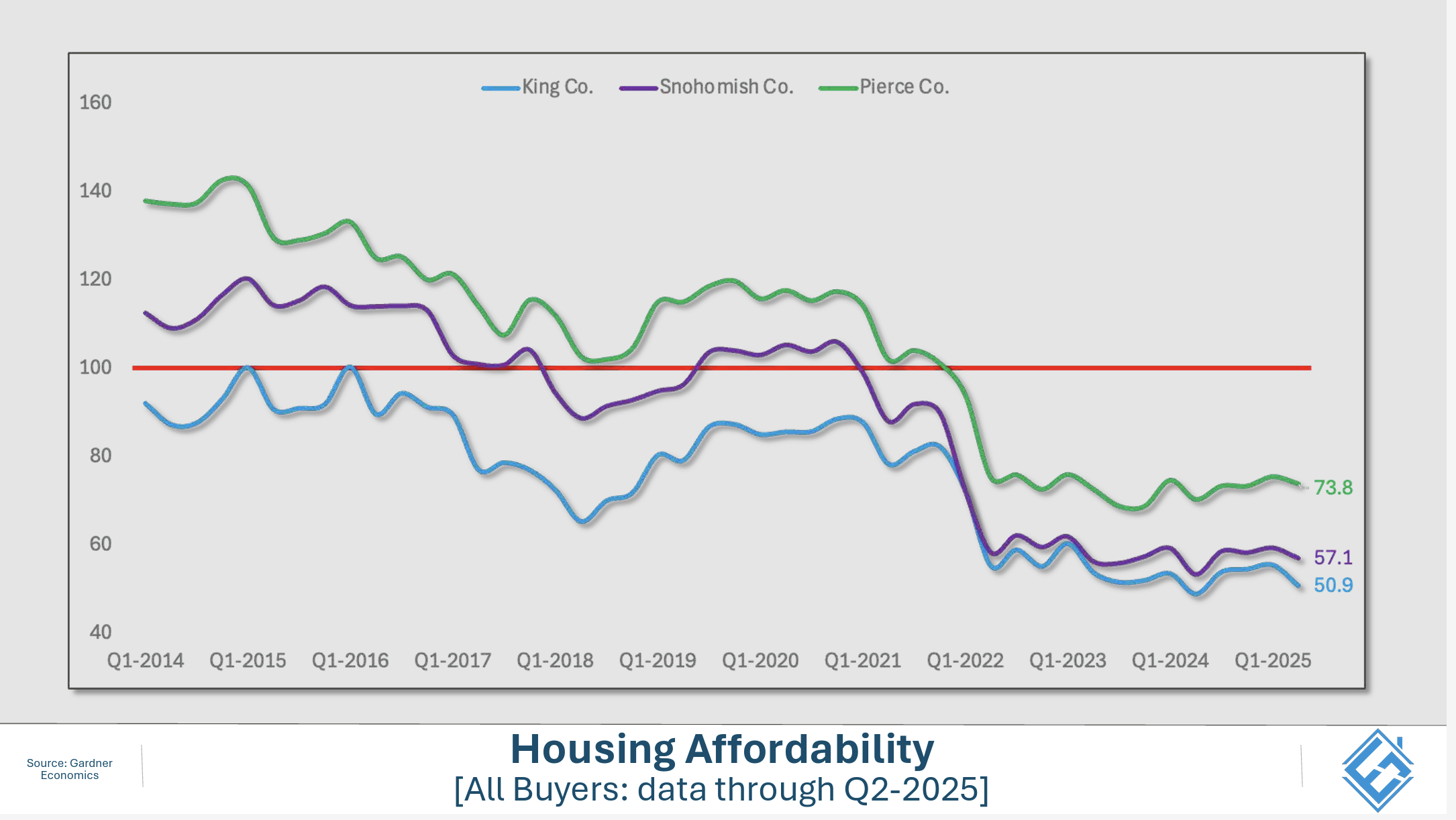

See overall affordability challenges below:

Onto the stats:

Seattle: September 2025 median sale price of $975,000. That is up 3.9% YoY, but down MoM from $1,000,000. Note, this was the first month since March that Seattle didn't notch a median sale price of $1m+. Inventory is up 12.1% YoY and the months of inventory increased to 3.08 months from 2.25, which is fairly significant.

Eastside: September 2025 median sale price of $1,575,000. That is up 3.1% YoY, and down MoM just $10,000. Inventory remains highly elevated at 60.3% more homes on the market YoY, yet the months of inventory increased only slightly to 2.79 months from 2.68 MoM.

King County: September 2025 median sale price of $957,000. That is up .7% YoY and down MoM from $990,000. Inventory is up 26.2% YoY and the months of inventory rose to 2.76 from 2.47 in August.

Have an amazing October! Onward!