Seattle Condo Market Update — September 2025

Happy Fall!

And welcome to the latest and greatest Seattle Condo Market Update. If you don't want to read and would rather watch, feel free to skip straight to the full YouTube video update here.

Good news and bad news for Seattle condo buyers

There was good news and bad news with September's stats for the Seattle condo market, depending on your perspective.

Ok, I'll give it a try. The good news is that sold inventory was up 45.2% YoY. 196 units sold in September of this year vs 135 units the month before. And YoY inventory is at its lowest mark (up 13.9%) year-to-date. In other words, inventory has been up YoY all year, it's just up at the smallest amount YTD.

However, the bad news is that the more sales resulted in lower sale prices. In fact, the median sale price for a Seattle condo in September registered the lowest amount ($523,687) since February of 2023. More sales, declining inventory, yet lower sales prices? Intuition would suggest the opposite, yet here we are. The optimist in me hopes this is the bottom and it's only up from here.

Why neighborhood matters for Seattle condo prices

Of course, the market is not a one-size-fits-all market. Geography plays a HUGE role in determining the expectations for sellers and I've reported A LOT on that in the past few months. For example, the months of inventory for Northwest Seattle (think Ballard, Greenwood, Green Lake, Fremont, Wallingford, etc) is 2.83 months. Contrast that to the Downtown/Belltown market of 6.71 months and you can see how important geography is.

Of course, the new construction backyard DADU's that you find in North Seattle don't exist in the downtown area so that also contributes to the vast difference since those are more desirable than units in high rise downtown buildings.

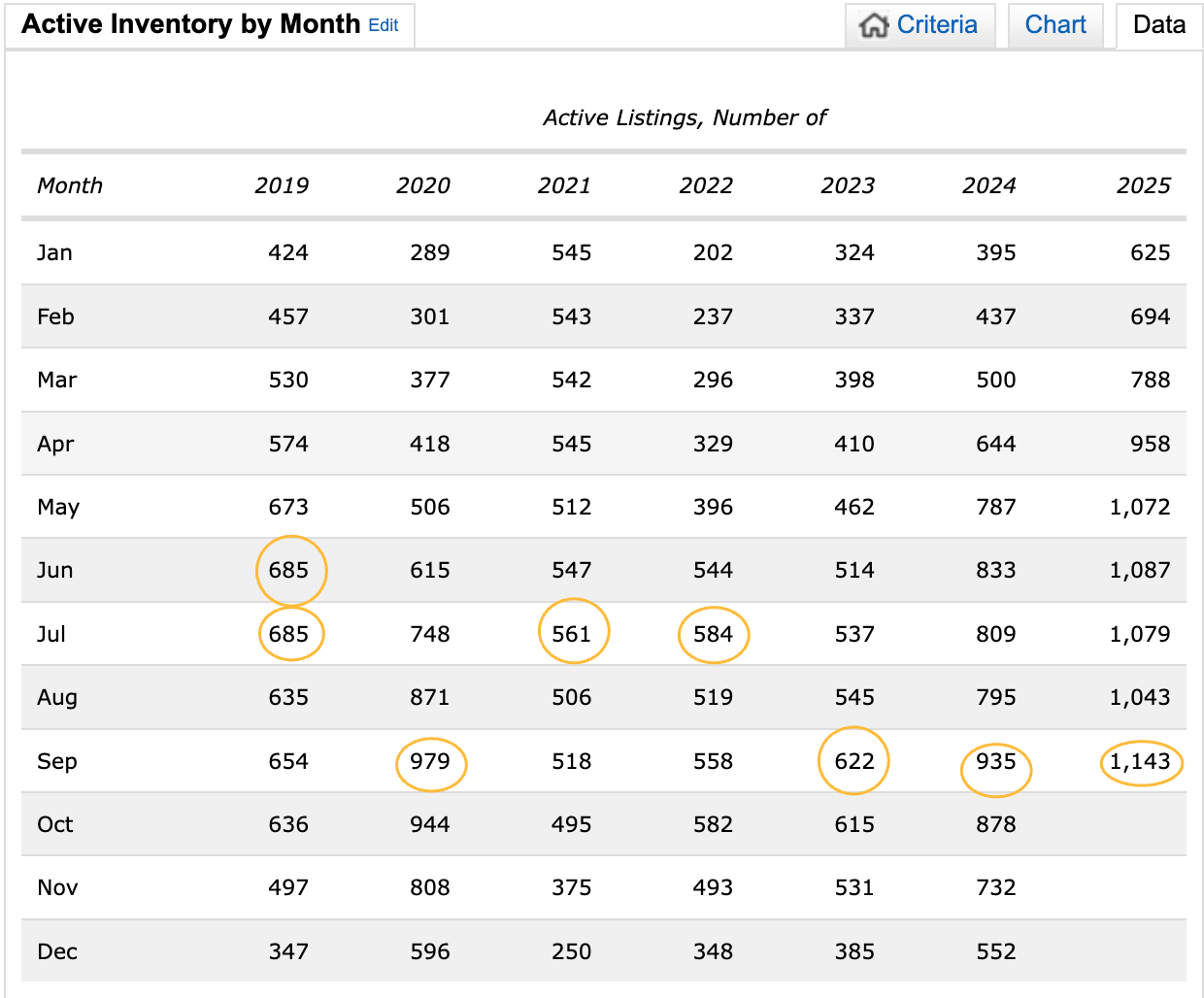

What inventory trends are telling us in 2025

Interestingly, over the last two years, and so far YTD, September has been the month of the year that's had the most inventory available. July is also well represented, too. We'll see if October can dethrone September.

Showing activity and what we’re seeing

Off topic, but something pretty cool that I just discovered. Our NWMLS has come out with a new tool tracking the amount of showings through the Supra keybox network. Granted, this data is across the entire NWMLS so there's no way for me to break this down into more microscopic data (county, cities, property types, ec), but it's interesting to see activity show exactly what we have been experiencing.

Despite more inventory growing during this time, showing activity decreases until after Labor Day, where it then picks up for two weeks, before declining again. But showing activity is up from last year, so that's good news (below). Again, not really tied to anything, I just found that interesting :)

Key Seattle condo stats for September 2025

Onto the stats:

The median sale price (as previously mentioned) for a Seattle condo in September 2025 was $523,687.

That is down 13.6% YoY and significantly down MoM from $595,000.

Inventory is up 13.9% YoY, and the months of inventory rose to 5.45 months from 5.18 the month prior.

Have an amazing Halloween. Onward!

Watch the full Seattle condo market update

Want more details? Watch my full Seattle condo market update video on YouTube for September 2025.